Real Estate APAC

Dedicated Asia Pacific direct Real Estate investment manager

What’s new

Who we are

Our Real Estate APAC team provides investors access to value-add and core-plus investment approaches, leveraging our long track record and presence in the region.

|

|

|

|

Source: HSBC AM, as of 30th June 2025

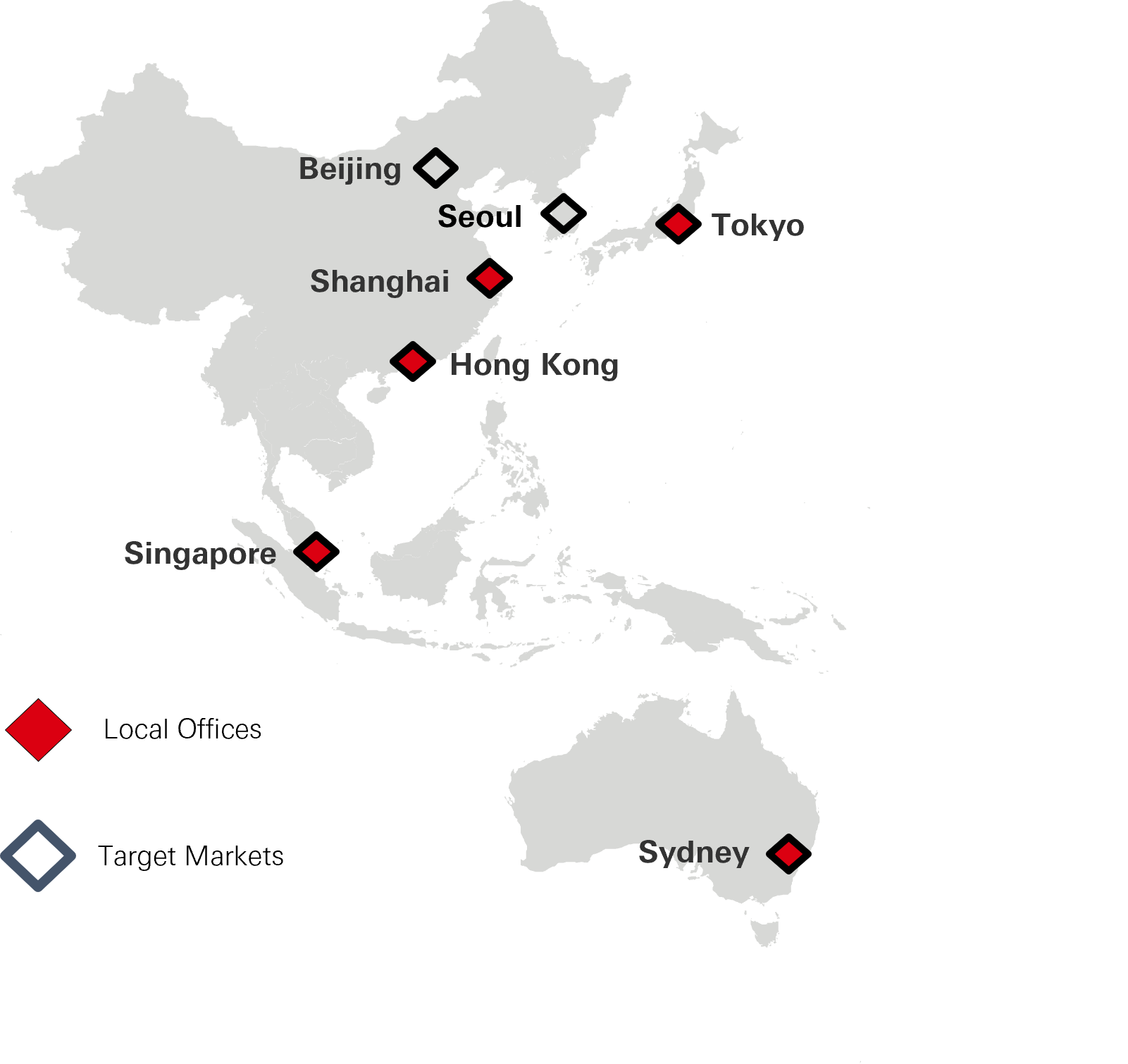

We target the most mature, institutionalised, liquid and transparent markets in the Asia Pacific Region

Our Investment Approach

|

Invest

|

Optimise

|

Realise

|

What we do

Our Portfolio

Our team currently manages over 20 properties in the region – representative properties include:

Experienced Investment Team

|

|

|

Leadership

25 investment professionals locally based across APAC

Peter Wittendorp, CEFA Head of Real Estate, APAC 30 years of real estate experience |

Berend Poppe, CFA Head of China 20 years real estate experience |

George Kang Head of Singapore 20 years real estate experience |

Nick Kearns, CFA Head of Hong Kong 20 years real estate experience |

Takashi Hamajima Head of Japan 20 years real estate experience |

Contact us

If you are considering investing in alternatives, or want to learn more about our investment strategies, please get in touch.

Formulate Strategic Asset Plan (SAP), ensuring a real estate asset is developed and / or managed to optimise long-term performance

Formulate Strategic Asset Plan (SAP), ensuring a real estate asset is developed and / or managed to optimise long-term performance