Real Estate APAC Quarterly Spotlight

Macro-wise, 2024 was a mixed bag

The global economy ended 2024 on a mixed note.

- Global headline inflation came down across most regions but progress on core inflation has been much slower, signifying that the global inflation story has become somewhat more uncertain

- That said, interest rate easing continued with the US Fed lowering interest rates by 25 bps in December 2024, the third consecutive reduction since September 2024

- Despite markets staying relatively optimistic post the US elections, the world is bracing for the impact of Trump’s proposed policy measures

What piqued our interest?

Real estate capital markets across the world, including APAC, showed more signs of meaningful stabilisation and hints of a new liquidity cycle in Q4 2024.

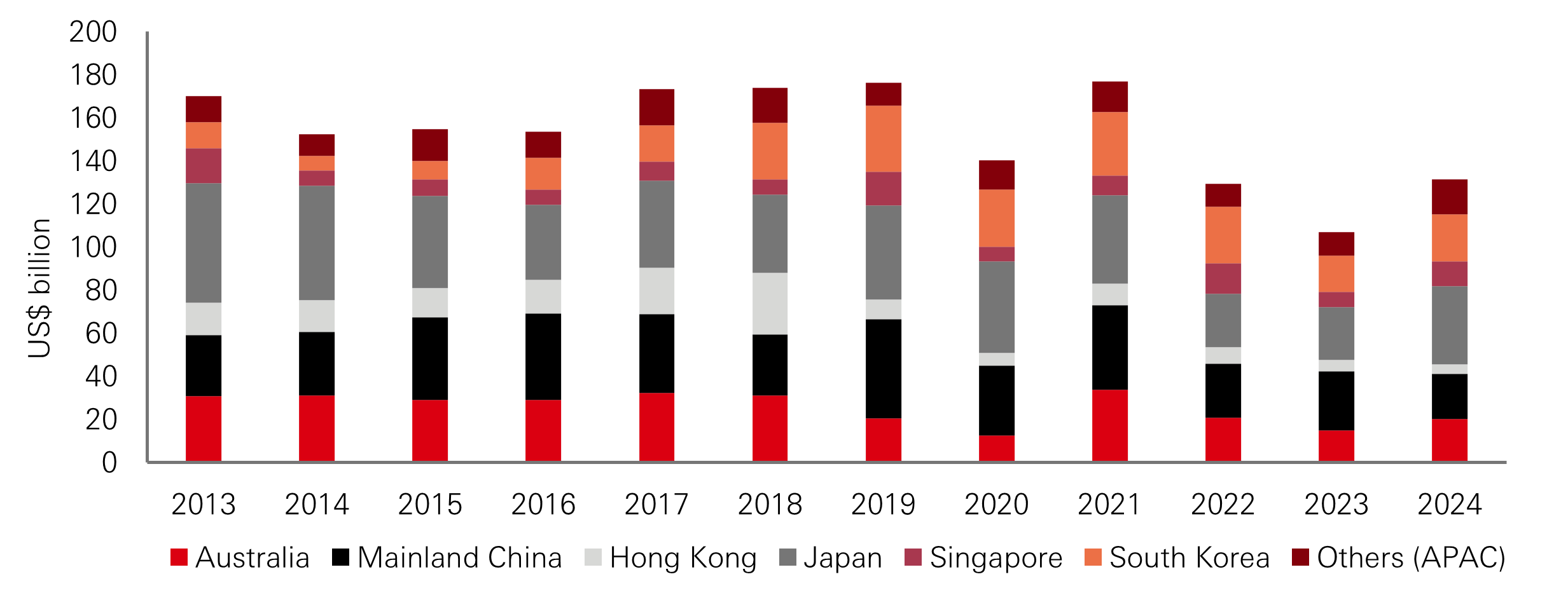

- Pick up in APAC real estate investment activity Investment volume in the region was up 10% YoY in Q4 2024 – this marked the fifth consecutive quarter of annualised growth while full-year volume grew substantially by 23% in 2024, surpassing 2022 levels according to JLL. A notable transaction in Q4 2024 was Blackstone’s and the Canada Pension Plan Investment Board’s acquisition of AirTrunk for US$16 billion, the largest commercial real estate deal ever recorded in APAC. Markets at the forefront of the recovery include Japan, Australia and South Korea

Figure 1: Annual Real Estate Investment Volume by Market

Source: JLL Research, as of Q4 2024

- Japan staying at the pole position According to MSCI Research, Japan posted its second consecutive year of record deal volume in 2024 amid the sustained weak yen and low borrowing costs, retaining its title as Asia Pacific’s most active real estate capital market. For a third consecutive year, Tokyo topped the region as the most active metro and was the top market for retail, residential and hotel sectors. Tokyo’s leasing markets also surprised on the upside, with expansionary sentiment staying robust in most sectors; notably, the city’s office and multifamily residential sectors saw steady and meaningful improvements to rents and vacancies through 2024

- China Stimulus 2.0 in the works More forward guidance from China’s central government on future stimulus measures – the December 2024 Politburo meeting pledged more fiscal and monetary support following China’s multiple policy rate cuts and unveiling of a large-scale local government debt swap plan, while the Central Economic Work Conference held in the same month saw policymakers calling for more support and enhanced policy coordination to maintain steady economic growth and lift confidence

- Nascent improvement in some Chinese markets Shenzhen saw housing sales and prices taking a turn for the better in Q4 2024, as well as its most expensive land sale in history in December 2024. China Overseas Land and Investment and China Resources Land jointly paid over US$2.54 billion for a 263,000-square-metre parcel in the city’s Nanshan district, which was 46% higher than the starting price. The land parcel was sold after nearly 300 rounds of bidding. Meanwhile, Beijing recorded an increase in deal activity in 2024 (14% YoY). There were also more investors, notably government-related and state-owned enterprises, exploring investment opportunities

- More green shoots of recovery in APAC’s challenged leasing markets For instance, in Hong Kong, full-year office leasing volume was 6.2% YoY higher than that in 2023 and the highest annual figure observed since 2019 according to CBRE; there was also a surge in industrial leasing activity in Q4 2024 (58% QoQ increase) led by e-commerce related firms

- Investor sentiment towards real estate turned more upbeat with JLL’s Global Real Estate Sentiment Survey in November 2024 indicating the strongest result in nearly three years – majority of respondents think conditions will improve further over the next six months. CBRE’s 2025 Asia Pacific Investor Intentions Survey also saw an improvement in buying intentions across most markets in the region

What was concerning?

Risks remain highly dynamic and volatility is expected to persist in the short term; the implications from Trump’s electoral victory and the proposed policies under his administration are unclear at this juncture.

- Trump 2.0? Trump’s second presidency adds risk to our outlook for Asia real estate. There remains many moving parts and little clarity regarding Trump’s new administration and proposed policies. Change in proposed policies with regard to US imports, could have material impact on Greater China given the weaknesses in local demand. Nonetheless, this strengthens the case for further stimulus in Greater China which may help lay the ground for a more concrete recovery in Greater China’s real estate markets

-

Rate cut cycle disruption The continued rise in geopolitical tensions, especially on the trade front, may result in a rebound in inflationary pressures which will disrupt the rate cut cycle. Several US Fed officials have confirmed in the first two months of 2025 that the US central bank will take a cautious stance in adjusting interest rates, and will only resume rate cuts when inflation meaningfully cools and policy uncertainties dissipate

- More developers in Greater China under stress Leading developers in Mainland China (Vanke) and Hong Kong (New World Development) have recently been in the headlines for default risk, raising concerns that the worst is far from over with regards to the current prolonged property market downturn and liquidity crisis in Greater China. Notably, investors are concerned about the possibility that a fallout of these large developers will generate secondary negative impacts on the macroeconomic environment, property sector and overall investment sentiment. Notwithstanding, Vanke’s recent management overhaul showcased Shenzhen Metro’s strong commitment to resolving Vanke’s liquidity issues, while New World Development’s parent company, Chow Tai Fook Enterprise has been supporting its business restructuring; at the same time, Vanke has been active in asset disposals over the year and there is some progress in monetising assets and repaying debt – this brings us to the view that risks are well-contained

What do we expect?

After a period of transition in the commercial real estate cycle over the past two years, we are cautiously optimistic of a tentative revival for Asia real estate in 2025.

- However, we expect the path to recovery for the region’s commercial real estate markets to be relatively patchy as market players continue to grapple with risks relating to geopolitics, construction costs, as well as the pace and magnitude of purported rate cuts in 2025

- On a more positive note, supply overhang issues are expected to start to ameliorate (at a gradual pace) given the refocus away from such “over-concentrated” sectors; in addition, leasing markets are expected to find a more concrete bottom in 2025 amid an improving leasing pipeline

- With interest rates starting to ease and asset repricing underway in several APAC real estate markets, investors are increasingly focusing on core to value-add investment strategies. According to CBRE’s 2025 Asia Pacific Investor Intentions Survey, core-plus and value-add were named the most popular strategies for 2025

- Japan and Singapore are expected to hold up as the top investment destinations in APAC, with the former buoyed by low interest rates, consistent rental growth and opportunities for positive yield spread and the latter underpinned by its stability and reputation as a safe investment haven. Australia has also been shown strong signs of market recovery, although many investors continue to assess current repricing and interest rates trends

- Greater China’s real estate markets have been in a prolonged downturn, having had to digest multiple shocks – pressure on the export sector, domestic corporate reforms, an unprecedented housing market crisis and plummeting consumer confidence. Coupled with the ongoing geopolitical bifurcations, there has been pronounced investor aversion to these markets. Data from MSCI Real Capital Analytics point to around a quarter of real estate investment volume in Mainland China in 2024 being distressed sales, while Colliers International estimated close to 40% of the commercial real estate transactions in Hong Kong were distressed sales or capital loss deals. Our current assessment of market conditions in Greater China is that they will not substantially change until 2026. Notwithstanding, we believe 2025 to be a window of opportunity for investors who believe in China’s underlying growth fundamentals and are looking for more opportunistic returns

The views expressed above were held at the time of preparation and are subject to change without notice. For informational purposes only and should not be construed as a recommendation for any investment product or strategy. The commentary and analysis presented in this document reflect the opinion of HSBC Asset Management on the markets, according to the information available to date. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in Turkiye by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as investment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given herein may not give rise to results that fit your expectations.

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

Copyright © HSBC Global Asset Management Limited 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.

Content ID: D041035_V1.0; Expiry Date: 31.01.2026