Utilising Securitised Credit within your Asset Allocation

Overview

- Securitised Credit has been the best performing asset class within fixed income over the past two years; 2024 is likely to continue in a positive manner

- The asset classes’ floating rate nature can provide a cushion against duration volatility

- The sector also has a low correlation to traditional asset classes, providing diversification benefits that cannot be ignored from an asset allocation perspective

- Over the longer term, Securitised Credit has had a lower correlation, superior performance and lower volatility compared to traditional fixed income

- Regulations and oversight have changed significantly since 2008 and concerns over the whole asset class seem unfounded

- Given the above points, institutional investors continue to allocate to this asset class; making it a key consideration for multi-asset allocators

Introduction

Adding Securitised Credit to a client’s asset allocation can have noteworthy benefits. These include:

- Diversification: Securitised Credit is predominantly floating rate and does not have duration. The sector therefore moves differently to other asset classes during economic cycles and offers an alternative source of risk-adjusted returns

- Yield enhancement: Being floating rate, the coupons of securities increase as interest rates increase, paying more than traditional fixed income

- Credit exposure: The asset class is specifically a credit offering. Therefore, investors are able to obtain exposure to the relevant level of risk that suits their risk/return targets within the spectrum of credit securities. There is also the potential for spread compression as an additional layer of returns.

Some investors may exhibit caution when considering an allocation to the asset class, with memories of 2008 in the background. However, we believe that the Securitised Credit market as a whole has been unfairly profiled and only a small and very specific part of the market was the focal point.

Furthermore, areas such as CLOs, CMBS and Prime RMBS which remained resilient during this historic and tumultuous market period, could actually diversify and sharpen the credit profile of a multi-asset portfolio as losses are favourably comparable to corporate bonds.

Diversification benefits

When we look at historical correlations, what is clear from the below illustration is that Securitised Credit has a low correlation to all sub asset classes of traditional fixed income when looking at global indices. But this is also visible in regional correlations.

This makes sense given the fact it has a unique return, volatility and duration profile. For a multi-asset allocator, this makes it hard to ignore from the lens of diversification.

Correlation to traditional fixed income is low

Source: Bloomberg, HSBC Asset Management Performance datas for the HSBC Global Investment Grade Securitised Credit fund, ICE BofA Global Corporate Index, ICE BofA Global High Yield Index, ICE BofA EM External Debt Sovereign Index and ICE BofA Global Government Index are for the period May 2019 to May 2024 on a monthly basis.

Moving on from the 60/40 portfolio

Traditional fixed income has historically been viewed as a diversifier to equities and has had a low/negative correlation with equities. We are all well versed with the “60–40” portfolio.

However, the lower for longer interest rate environment, the subsequent “Great Fixed Income Reset” and now a potential higher for longer scenario has forced investors to reconsider their asset allocations. The correlation between equities and fixed income has indeed increased in recent times.

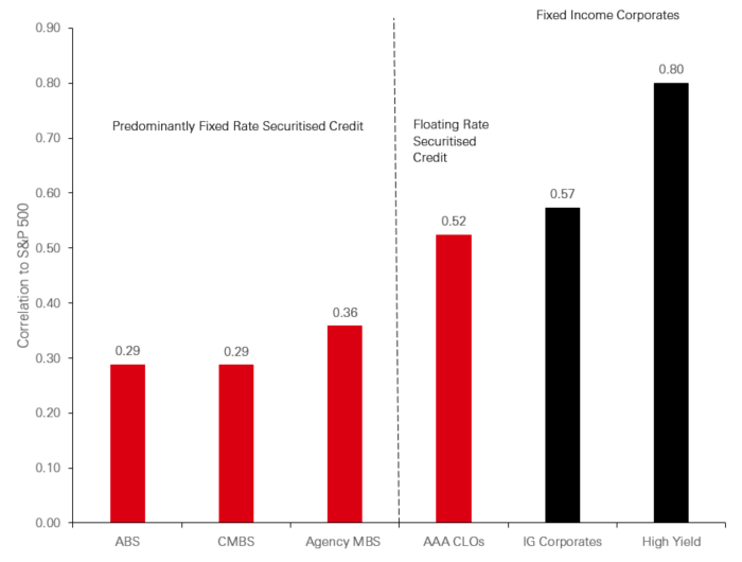

Not only does Securities Credit have a low correlation to fixed income (highlighted above), it also has a lower correlation to US equities than corporate bonds making it a key consideration for multi-asset investors.

Securitised Credit sectors have a significantly lower correlation to U.S. equities than corporate bonds

Source: Bloomberg, HSBC Asset Management

Note: Monthly correlations for the 10-year period ended 31 May 2024. Indices used to represent asset classes: ABS (Bloomberg U.S. Agg ABS Index), CMBS (Bloomberg U.S. CMBS Investment Grade Index), Agency MBS (Bloomberg Mortgage Backed Securities Index), AAA CLOs (J.P. Morgan CLO AAA Index. These underlying assets are leveraged loans to companies), IG corporates (Bloomberg U.S. Corporate Investment Grade Index), High yield (Bloomberg U.S. Corporate High Yield Index)

Why does diversification matter?

We show on the previous page that Securitised Credit has a noticeably different return profile from traditional fixed income and equities. Not only has this meant the asset class has low correlations because of the lack of duration, it is also the main driver of risk-adjusted returns.

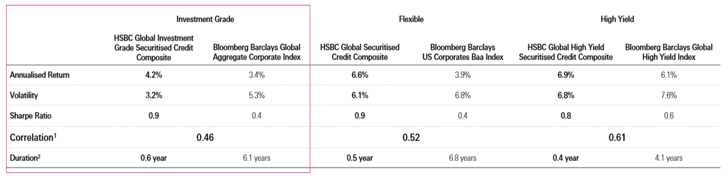

Of course, higher interest rates (leading to higher income levels) and resilient economic growth (lower spreads as a result of improving credit fundamentals) is the most accommodative environment for the asset class. It allows investors to benefit from income and capital appreciation.

However, one might be intrigued to know this has not just been through a higher interest rate environment. Securitised Credit has not only had higher returns than fixed income corporates over the longer term, it also has had a lower volatility and thus higher Sharpe ratios over the past 14 years. Investment Grade Securitised Credit has had an annualised return of 4.2 per cent versus the Bloomberg Barclays Global Corporate Index returning 3.4 per cent over the same period. What’s more is the volatility of Investment Grade Securitised Credit is much lower than its corporate fixed income cousins at 3.2 per cent vs 5.3 per cent respectively.

The asset class benefits from a complexity premium as it an over-the-counter (OTC) hand traded market that requires deep credit research resources to unlock value.

There is also an illiquidity premium as the asset class is slightly less liquid than its corporate cousins across the rating stack. Although, this is less pronounced at the higher rated securities than the lower rated ones.

As a result of this, even during periods where interest rates are low and coupons are lower, spreads will likely remain above that of fixed income, making an allocation to high quality Securitised Credit an interesting option for investors.

Securitised Credit track record of returns

Source: Bloomberg, GIPS, HSBC Asset Management, as of 30 April 2024

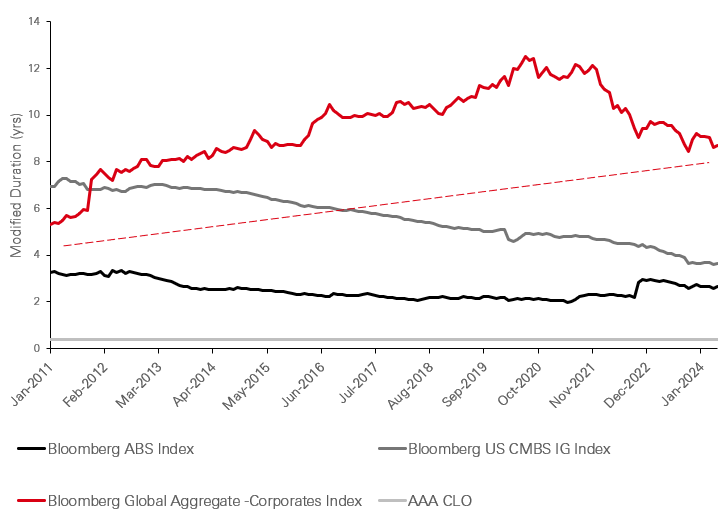

Duration protection still matters

Securitised Credit has and will likely continue to benefit from the current macroeconomic environment. High interest rates has meant the asset class is generating high levels of income.

Many now believe that the direction for interest rates from here is lower. Although we don’t necessarily disagree with this point, the final destination is unlikely to be zero. Interest rates are more likely to move to a more neutral rate. As Securitised Credit made money when interest rates were zero, it is all the more likely the asset class will make money at more neutral levels.

Looking at the past 20 years, the Global Aggregate’s duration profile has increased significantly which would have been a positive for returns in the lower for longer environment. Going forward, as we move between favourable data points and inflation overshoots, too much duration exposure can prove costly.

Adding an asset class that has no duration exposure, delivers attractive income and provides diversification benefits seems an opportune time for investors.

The importance of hedging duration

Source: Bloomberg, HSBC Asset Management

So, interest rates are going down but where will they end up?

We believe that the destination for rates will be towards their neutral rate. Currently, this is estimated at 3.5 per cent–4.0 per cent for the US. At these levels, income would still be high within Securitised Credit.

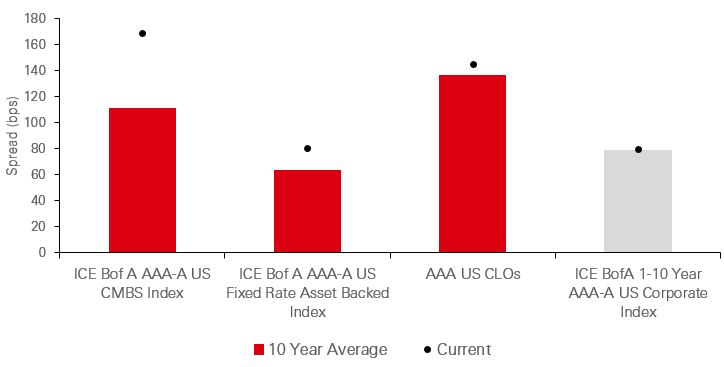

Interestingly, the additional layer of capital appreciation could boost returns further, with lower interest rates reducing the strain for borrowers and resulting in credit spread compression.

In fact, spread compression is more likely in Securitised Credit than corporates. Spreads in the sector are at historical wides as illustrated in the chart below as a result of market shocks such as COVID-19, the LDI crisis in 2022 and ongoing geopolitical tensions.

The same cannot be said for corporates which are at spread tights and one would likely expect the difference in spreads to narrow over time. One can argue from an asset allocation perspective that high quality Securitised Credit is more attractive than high quality corporate bonds at this point in the cycle, given the potential for spread tightening within the asset class.

Securitised Credit spreads are at historical wides

Source: Bloomberg, HSBC Asset Management as of 31 May 2024

The elephant in the room

When some investors hear “Securitised or Structured Credit”, 2008 GFC flashbacks are never far away. However, from a default perspective, most Securitised sectors remained relatively robust to defaults (outside of the initial risk-off credit market shock).

The epicentre of the crisis revolved around areas such as Subprime Mortgages and securities backed by mortgages to poor quality borrowers (US Non-Conforming RMBS) and highly levered securities backed by mortgages to these sub-prime borrowers (Collateralised Debt Obligations (CDOs)). This also included the infamous no income no job application (NINJA) loans that experienced significant losses during this challenging period. Yet the whole sector has been unfairly tarnished due to these isolated market segments.

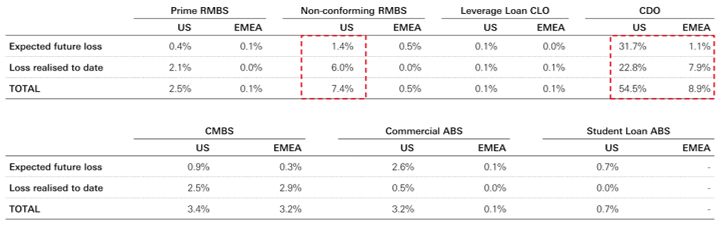

Data from Fitch shown in the table below, demonstrates how resilient the Securitised Credit sector as a whole was. It also highlights that it may be possible to control risk by focusing on specific areas of Securitised Credit, whilst avoiding others.

Arguably, the loss data in these areas rivals that of traditional fixed income defaults during the same period. The table below shows that sub-prime RMBS lost 7.4 per cent in total and the highly levered CDOs lost 54.5 per cent.

However, other sectors such as Prime RMBS, CLOs, CMBS, ABS and student loans were more resilient as the defaults ranged from 0.1 per cent–5.4 per cent, which is more than comparable to other asset classes.

Global Securitised Credit Losses: 2000–2018 Issuance

Sources: Fitch Ratings, Global Securitised Finance Losses: 2000 – 2018 Issuance, Special Report US Jul 2019; Special Report EMEA May 2019. Simulations are based on Back Testing assuming that the optimisation models and rules in place today are applied to historical data. As with any mathematical model that calculates results from inputs, results may vary significantly according to the values inputted. Prospective investors should understand the assumptions and evaluate whether they are appropriate for their purposes. Some relevant events or conditions may not have been considered in the assumptions. Actual events or conditions may differ materially from assumptions. Past performance is not a reliable indication of future returns.

What’s more is that since then, a lot of lessons have been learnt by both investors and regulators alike and there have been significant improvements over the last 16 years to the Securitisation market:

- Risk retention: One of the reasons for the poor quality of collateral in pre-crisis sub-prime RMBS was that many lenders adopted an “originate to distribute” model whereby loans were made with the intention to sell into Securitised Credit. The lenders therefore had no incentive to monitor the quality of the loans. EU regulation now requires sellers to maintain a 5 per cent or more stake in all new issue Securitised Credit. Such rules that encourage ‘skin in the game’ align interests between the issuer and purchaser of the securities

- Ratings agencies: One of the key areas of focus from the crisis was the role played by rating agencies. New regulations have been introduced to require multiple ratings, rotation of rating agencies for more complex deals and extra disclosure with an aim of encouraging new rating agencies to emerge. Transparency of rating methodologies has been improved and almost all rating methodologies for Securitised Credit have been updated

- Due diligence: There have also been changes to mortgage borrowing and who can qualify to obtain mortgages. Stringent stress tests are applied to individuals in order to prevent defaults even under unfavourable economic circumstances. Furthermore, gone are the days of excessively high loan-to-value (LTV) mortgages and mortgages cannot exceed specific multiples of a borrowers’ loan-to-income (LTI)

This has resulted in simpler structures and increased subordination required to support a given rating. Issuers/sponsors will also be required to disclose substantially more information in relation to new transactions regarding cash flows, deal structure and quality of the collateral, which will better help investors to evaluate the risks of deals.

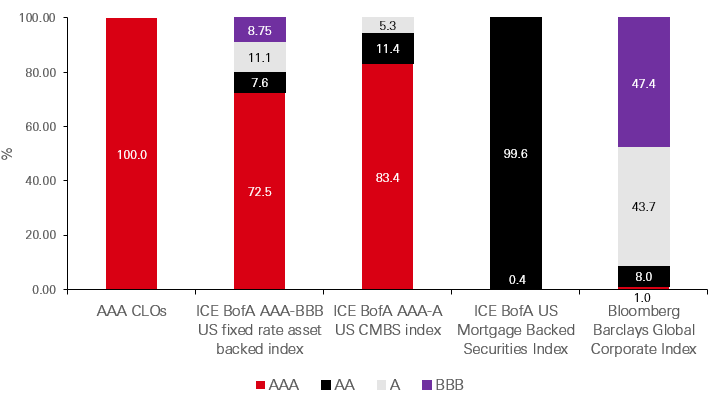

Given these structural changes with the Securitised Credit market, investors should reconsider an allocation. When we look at the credit quality of Securitised Credit, it could actually enhance a portfolio due to the return dynamics and the low correlations to traditional assets. Somewhat ironically, Securitised Credit indices currently are comprised with higher rated securities than the corporate universe which leans heavily into BBB.

Fixed income and Securitised Credit sectors broken down by credit rating

Source: Bloomberg, HSBC Asset Management as of 31 May 2024

The demand is there

Another key consideration for institutional investors is the return, regulatory and operational benefits that a Securitised Credit allocation can provide.

- For insurance companies and subject to the underlying applied regulatory environment, it offers higher returns than traditional fixed income across all credit ratings with similar credit charges

- For pension funds and in particular LDI strategies, Securitised Credit can provide balance to their collateral waterfall, and it can provide liquidity when it is so desperately needed. The LDI crisis of September 2022 proved this where pension schemes had to sell their most liquid assets to meet urgent collateral calls. The Securitised market provided liquidity to those that needed it and to others a great secondary market opportunity. Other pension schemes have previously allocated to illiquid private debt, with the trend now being a reversal into more liquid Securitised Credit

- Multi-Asset allocators like the low correlation and diversification benefits

- Private Banks and Family Offices like the income generation

- Corporate Treasurers, looking for an alternative to cash, have been allocating to Securitised Credit within their strategic cash bucket

Given this, it should come as no surprise that this clientele has and will most likely continue to allocate to the sector.

Conclusion

Fundamentally, Securitised Credit offers investors with a compelling income, a hedge from duration volatility and the potential for further returns through spread compression. For a strategic asset allocator, the unique return profile, low correlations to traditional asset classes and superior Sharpe Ratios make it an important consideration. There is a misunderstanding on what areas of Securitised Credit actually caused the GFC and the sector has significantly evolved since then. From a risk standpoint, one could reasonably suggest the asset class is much more resilient than at first glance. Institutions are increasingly looking through the noise and acquitting and allocating to the asset class; something we believe will boost risk-adjusted returns in the new higher for longer paradigm.