India fixed income – Elections, inclusion and allocation

Key information panel

- India is now towards the end of its six-week long general election process, with markets as of now discounting a third consecutive win for the Modi-led NDA. Though there is a possibility of market volatility during election time, India’s bond markets operate against a strong macro framework that has been strengthened by continuing reforms over the last three decades

- The RBI will likely hold off any rate cuts until the headline inflation has trended below the mid-point of the target band. We do not expect the RBI to ease policy rates until the last quarter of FY2025

- India bonds’ index inclusion by JPMorgan and other potential index providers is expected to not only bring about significant passive inflows into the market but could also become a catalyst for strategic allocations

- Flows from index inclusion should contribute to increasing demand for India government bonds, while a declining fiscal deficit should lead to decreasing supply. As a result, with the demand-supply wedge widening, bond yields are expected to move lower

- We believe India bonds merit a standalone allocation in a global portfolio, given their strong historical risk-adjusted returns, low correlations with other major asset classes, relatively high yield, stable currency outlook and macroeconomic support

Macro backdrop

The election factor

India is now towards the end of its six-week long general election process. The 543 Lok Sabha seats, along with the mandates of four state governments, are subject to change, with the election results to be finalised on the 4th of June. The policy platforms of both the incumbent governing coalition, the National Democratic Alliance (NDA), and its major opponent, the Indian National Developmental Inclusive Alliance, are both more reformist and forward looking. Apart from the possibility of one of these two parties winning absolute majority, there is a third possible election outcome of a mixed mandate, which could bring about uncertainty in the political scenario. Markets as of now seem to be discounting a third consecutive win for the Modi-led NDA.

Historically, Indian election results tend not to impact bond markets in a significant manner, though it is possible that we may see some volatility in currency and rates around election time. India’s bond markets benefit from a macro framework that has been strengthened by continuing reforms over the past three decades – some recent examples include the Goods and Services Tax, digitalisation of payments, establishment of the Monetary Policy Committee (MPC) and its inflation-targeting regime, and an increasing fiscal emphasis on infrastructure development. Given the strong macro backdrop, any volatility in markets can be an opportunity for a consolidation of positions.

Inflation trending lower

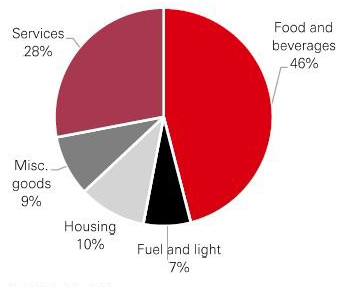

There are some favourable signs indicating that inflation is already trending lower. A notable encouraging factor is the Indian Meteorological Department’s prediction of an above-average monsoon rainfall in 2024, estimated to be 106 per cent of the long-term average, which brightens up prospects for good harvest and is thus helpful for food inflation. Also, the El Nino and La Nina effects of the current year might not be as disruptive as previously projected. As seen in Fig. 1, food and eatables are the most substantial component of consumer price inflation.

Oil and energy prices is another component that is crucial to inflation numbers, given India’s current reliance on imports to meet 80 per cent of its national oil demand. To note, is India’s focus on expanding its renewable energy capacity to fulfill 50 per cent of national electricity demand by 2030, potentially reducing its reliance on oil imports in the longer-term.

Given that the RBI projects that inflation will be around 4.5 per cent for FY2025, we expect the Indian central bank to remain watchful on the inflation trend. We expect the RBI to hold off on any rate cuts until headline inflation has trended below the mid-point of the target band. Core inflation (excluding food and fuel) has already been trending below 4 per cent. The RBI is expected to remain patient on rate easing and may only act in the last quarter of FY2025.

Fig. 1: Food is a major component of inflation

CPI inflation components

Source: MoSPI India, May 2024

Index inclusion flows – a catalyst for strategic allocations

JPMorgan’s index inclusion is a pivotal event for India’s bond market, which is expected to result in about USD 25bn of inflows into the asset class through index tracking passive funds.1 Bloomberg Emerging Market Local Currency Government Index is also confirmed to add India in early 2025, leading to another estimated USD 5bn of inflows. We believe the potential inclusion of India bonds by Bloomberg Global Aggregate Index could also materialize in the next few years and lead to another USD 20-25bn of inflows.

Apart from these passive inflows, we are seeing more interest from active investors in India bonds as increasingly more investors are discovering an under-explored market. This may easily match the passive fund activity and we expect to see similar (about USD 50 billion) flows into active funds as well. Thus, the increased interest in India bonds from both passive and active investors may add another USD 100bn of flows into the asset class over the next 3-5 years. From the perspective of a global investor, index inclusion of India bonds could become a catalyst for strategic allocations.

We believe that there is a strong case for strategic allocations into India bonds. The asset class offers portfolio diversification benefits and value. The India bond market is adequately large – in fact, India’s government bond market, sized at USD 1.4 trillion, is amongst the largest within emerging markets2 – and is also reasonably liquid, with daily liquidity varying from USD 2-4bn of market volume for government bonds. Importantly, the market operates against a backdrop of macroeconomic stability and conducive monetary policies.

While this inclusion is only applicable to government bonds, it should be noted that the large positive inflows are expected for the rest of the bond market. Since the index inclusion announcement in September 2023, the India bond market has already attracted USD 11bn of net foreign inflows3 – well before the official start date of index inclusion. Index inclusion should bring about medium-term support for various segments, including corporate bonds.

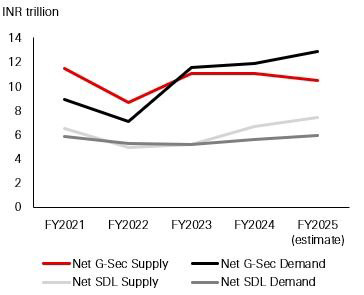

Fig. 2: Net demand and supply of government bonds (ex of RBI)

G-Sec refers to government securities, SDL refers to Senate Development Loans.

Source: Reserve Bank of India, February 2024/FY 2025 is HSBC estimate.

Index inflows are also expected to benefit the demand and supply dynamics of India government bonds. The demand supply equation has shifted towards more demand (ex of RBI) than supply in FY2024 and FY2025. We estimate that the demand supply wedge has widened due to index related bond demand as well as lower fiscal deficit (lowering the supply of bonds). This should lead to a downward move in bond yields.

In the HSBC India fixed income strategy, we have increased duration in our India government bond holdings, which we believe will be the first among India bonds to reap the benefits from the widening demand-supply gap. We have also added to our position in USD bonds out of the expectation that US rates may ease in the medium term from the recent spikes. We have not increased our position in corporate bonds as spreads in this space are relatively unattractive.

Compelling case for standalone allocations in India bonds

Policy credibility leading to rates trending lower: The investment case for India bonds remains compelling over the medium to long term. While in the period between 2010-2016, India 10-year government bond yields traded above 8 per cent with occasional spikes into the 9 per cent plus range, the recent 7-year period since 2017 has seen yields hardly move even above 8 per cent – in contrast US 10-year government bonds moved from 0.5 per cent to 5 per cent in the same period.4 Hence, the spread between India and US 10-year government bond yields has drifted down to about 265bp now.4 In our view, this is a trend that is here to stay and can be ascribed to increased policy credibility.

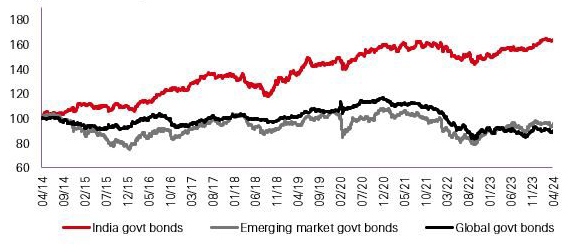

Performance: With the index inclusion around the corner, it is noteworthy to compare the performance of India with emerging market bonds as well as global bonds. India has meaningfully outperformed both of these markets on a USD unhedged basis, in the past 10 years (Fig. 3).

Fig. 3: India bonds have outperformed global and EM bonds (unhedged USD)

Index performance: 30-Apr-2014 = 1005

Source: Markit, JPMorgan, FTSE, Bloomberg, 30 April 2024

Low correlations: An advantage that India bonds offer is that of portfolio diversification, as they exhibit low correlations with other asset classes – all the more valuable in the heavily correlated world we are in. India bonds’ correlation against global bonds in the past 10-year period is only 0.11.6

Relatively high yields: India government bonds yield 7 per cent-7.50 per cent and are among the highest yielding bond markets, barring a few markets such as Brazil. Stable currency outlook: The other critical leg of the value proposition is the currency. Our outlook on the Indian rupee is positive, supported by a strong macroeconomic environment and healthy FX reserves buffer. Moreover, the increasing prevalence of manufacturing and continuing strong services exports, along with growing investment flows (including those driven by index inclusion), will lend long-term support to the strength of the rupee. In the more immediate time horizon, the RBI has shown proactiveness in stabilizing the rupee, using its ample FX reserves.

We believe that these factors combined with macroeconomic support and robust regulatory framework form a strong investment case for standalone and strategic allocations into India bonds.

Note 1: India bonds will be included in JPMorgan’s emerging market indices, including EMBI, GBI-EM and CEMBI series, starting June 2024. India is expected to reach the maximum weight of 10 per cent in the GBI-EM Global Diversified Index (GBI-EM GD), and inclusion will be staggered over a 10-month period. Only fully accessible route (FAR) securities will be eligible. Source is JPMorgan, March 2024.

Note 2: Source is Bloomberg, March 2024.

Note 3: Source is NDSL, 21 May 2024

Note 4: Bloomberg, May 2024.

Note 5: Indices used for India govt bonds: Markit ALBI India TRI Hedged USD; Emerging market govt bonds: J.P. Morgan GBI-EM Global Diversified Composite Unhedged USD; Global govt bonds: FTSE World Government Bond Index Unhedged USD.

Note 6: Using FTSE WGBI Unhedged USD and Markit ALBI India TRI Unhedged USD indices as of April 2024.

Source: HSBC Asset Management, May 2024.

Investment involves risks. Past performance is not indicative of future performance. Any forecast, projection or target contained in this presentation is for information purposes only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecasts, projections or targets. The views expressed above were held at the time of preparation and are subject to change without notice. The information provided does not constitute any investment recommendation or advice. For illustrative purposes only. Investment involves risks. Past performance is not indicative of future performance. Any forecast, projection or target contained in this presentation is for information purposes only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecasts, projections or targets. The views expressed above were held at the time of preparation and are subject to change without notice. The information provided does not constitute any investment recommendation or advice. For illustrative purposes only. The information contained in this publication is not intended as investment advice or recommendation. Non contractual document. This commentary provides a high level overview of the recent economic environment, and is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. The performance figures displayed in the document relate to the past and past performance should not be seen as an indication of future returns. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Global Asset Management accepts no liability for any failure to meet such forecast, projection or target.

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The capital invested in the fund can increase or decrease and is not guaranteed. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, fund manager’s skill, fund risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade. Mutual fund investments are subject to market risks, read all scheme related documents carefully.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Argentina by HSBC Global Asset Management Argentina S.A., Sociedad Gerente de Fondos Comunes de Inversión, Agente de administración de productos de inversión colectiva de FCI N°1;

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Further information may be obtained about the state guarantee to deposits at your bank or on www.sbif.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Stockholm branch of HSBC Global Asset Management (France), regulated by the Swedish Financial Supervisory Authority (Finansinspektionen);

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- in Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments”;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

NOT FDIC INSURED ◆ NO BANK GUARANTEE ◆ MAY LOSE VALUE

Copyright © HSBC Global Asset Management Limited 2024. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.