The UAE: A well-oiled growth machine

Key takeaways

- The UAE has cultivated an environment conducive for commercial prosperity through political stability, business-friendly policy, and excellent infrastructure which harnesses its globally strategic location

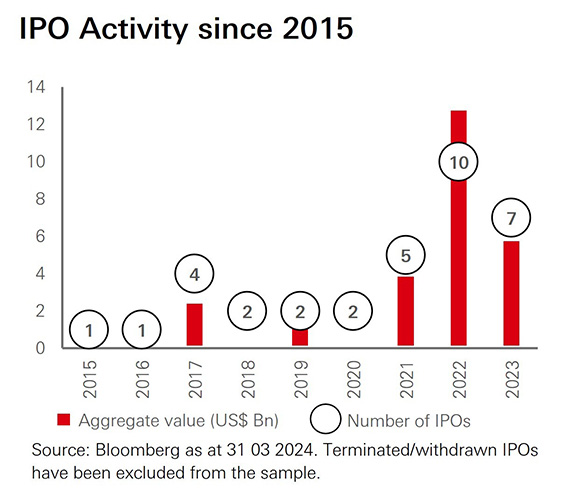

- Since emerging in 2000, the UAE's listed Equity Markets have grown significantly, contributed to by a number of IPOs in recent years

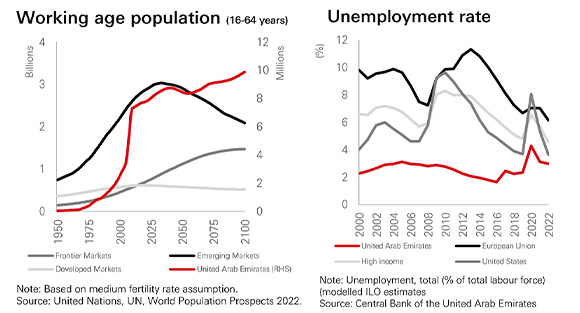

- The country also has highly favourable demographics, with expectations of continued growth in its working age population and very low unemployment

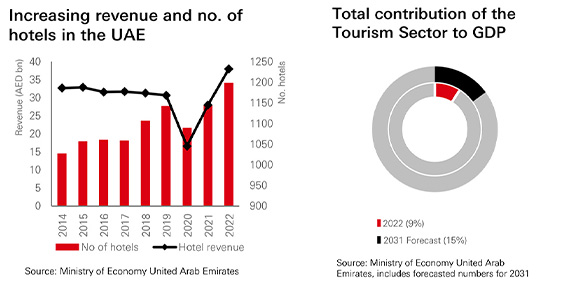

- The UAE has also successfully diversified its economy's sources of revenue, notably through a significant growth in tourism

The UAE: A well-oiled growth machine

The United Arab Emirates (UAE) was promulgated in 1971 as a union of seven emirates. From relatively humble beginnings of fishing and pearl trading, to the commencement of oil exportation in 1962, they became one of the ten largest oil producers in the world and are long-standing members of the Organization of the Petroleum Exporting Countries (OPEC) and the Gas Exporting Countries Forum (GECF). Today they are one of the Gulf Cooperation Council (GCC) countries that has built a strong name for itself worldwide and stands as a prominent example of rapid economic transformation, presenting a unique opportunity for global investors.

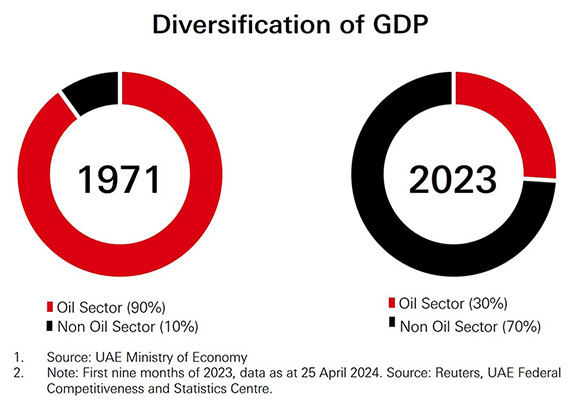

To last the sands of time, the revenues deriving from exporting oil has been helping the government fuel its pivot to continually evolve and effectively diversify its economy away from oil via initiatives including infrastructure developments and urbanisation. The charts below help illustrate this major shift in GDP terms:

This diversification has been attracting increasing foreign commercial investment into the UAE. They have established an environment conducive for commercial prosperity by:

- becoming renowned for political stability

- having a business-friendly environment

- being strategically and geocentrically located

- hosting world-class infrastructure

Although other GCC member states have many similarities, whether it be their macroeconomic conditions, cultural commonalities, reliance on an expatriate workforce, and dependence on oil resources, we still see standout opportunities in the UAE.

Some of the major investment opportunities and themes we see driving the change are:

- Liberalisation

- Attracting investment (IPOs)

- Strategic location, stability and world-class infrastructure

- Population demographics

- Tourism

Liberalisation

One of the primary themes we are seeing in the UAE and wider GCC region, are the strides taken by government to enact sweeping economic and social reforms. These reforms are orchestrated to take regional leadership, attract foreign investment, and diversify and induce economic growth via greater social and economic liberalisation. The UAE government has sought a competitive edge with several recent landmark changes:

Foreign ownership liberalisation (2021)

- 100 per cent foreign ownership is now permitted* with the enactment of the Commercial Companies Law amended

- The law annulled the obligation for local commercial companies to have a major Emirati ownership, scrapping the prior 49 per cent cap

- This also allows for a single foreign shareholder for limited companies

- It's important to note that whilst restrictions remain on some sectors (E.g. Oil and Gas, Utilities) these reforms have been positive, boosting FDI, diversification and the overall attractiveness of listing in the state

*Federal Decree-Law No. 26 of 2020 amending the provisions of Federal Law No. 2 of 2015 on Commercial Companies.

Legal Reforms: also covering Trademarks (2021)** and Data Protections (2021)***

- In order to improve efficiencies and cost savings, the UAE has introduced new laws to facilitate multi-class trademark filings

- These are now enforceable without the requirement to register on the UAE’s official register

- The UAE has taken legislative action, bringing in new laws to protect personal data

**Federal Decree-Law No. 36 of 2020 ***Federal Decree-Law No. 45 of 2020

A new workweek (2022): has been adopted for closer alignment with Global Markets and to improve economic competitiveness

- The UAE was a first mover in shifting their traditional work week, observed in most Middle East countries, from a Friday/Saturday to a Saturday/Sunday weekend model. This facilitates smoother trade and transactions with international markets, for example, the financial sector will benefit, aiding stock market operations and global banking

- They are also the first country in the world to formally implement a shorter than five-day work week as Friday was set as a half day

Talent retention

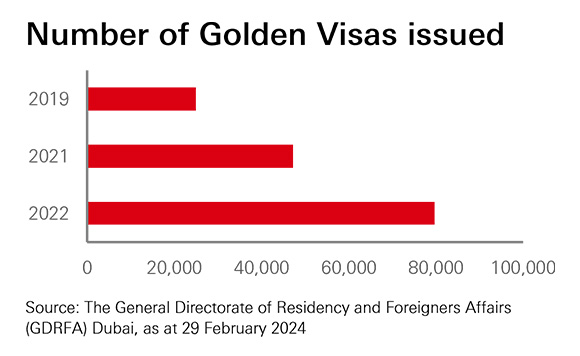

- There has been social liberalisation, with the introduction of several new visa schemes (Golden Visa, 2019) to attract and retain talent. Pathways have been devised for long-term expatriates/residents to gain Emirati citizenship incentivising further migration to the region

Source: U.AE The United Arab Emirates’ Government portal, Al Tamimi and Co., TheGuardian.com, and HSBC Asset Management as at 31 March 2023

Attracting investment

The Millennium marked the beginning for UAE’s listed Equity Markets

The history of the UAE equity capital markets is a relatively recent story when compared with other global markets. The first of the three major stock markets established was the Dubai Financial Market (DFM) in March 2000, shortly followed by the Abu Dhabi Securities Exchange (ADX) later that year. The third and most recent exchange formed to trade international stocks was the NASDAQ Dubai in 2005. These exchanges have paved the way for numerous companies to access capital in the UAE’s rise to the global stage and support a healthy, diverse market.

Global index provider, MSCI, further marked a new era for access to capital when it upgraded the UAE and Qatar in 2014 as member constituents to their Emerging Markets Equity Index, ahead of the rest of the GCC. This was a clear marking of UAE growth and regional leadership on the map for investors.

Attractive destination to list: the growing and diversifying IPO success story

Companies are attracted to list in the UAE for serval reasons, including strategic location, business friendly environment (such as low taxes), and the world class infrastructure. The current IPO landscape can be depicted as a dynamic blend of retail and institutional participation with a growing diversification of names. Companies continue to be listed spanning numerous sectors. The momentum of IPOs has been remarkable in recent years with plentiful appetite from investors attracted to the new listings. 2023 was coined the ‘Year of IPOs’ with an extraordinary number of first-time investors entering the UAE market1, and demand outstripping supply. Some oversubscribed examples included:

- ADNOC Gas covered 50x

- Dubai Taxi Co covered 130x (a region record at the time)

- PureHealth covered 54x intuitional, and 483x retail

Source: Government of Dubai Media Office, Bloomberg, 31 March 2024

The record was surpassed in March 24' by Parkin’s IPO in Dubai, a parking operations company, being oversubscribed 165x. The substantial demand speaks volumes for investor sentiment. The Government privatisation program has also led to several IPOs, with listings such as DEWA in 2022. We also may see four listings from the Abu Dhabi IPO Fund in 2024, in Tech, FX, remittance and hospitality further diversifying the membership away from hydrocarbons.

Source: Gulf News, UAE's retail investors made 2023 the 'Year for IPOs'

DFM 2023 growth

- Market capitalisation increased by 18 per cent to AED 688

- Foreign investors accounted for 47 per cent of trading activity

- 63k new investors of which 73 per cent were foreign

Notable early IPOs

- Emaar Properties (2000) continues to be one of the largest real estate developers in the region which sought to expand its capital base to fund further development projects. Following the IPO, they announced plans to build Dubai Marina and later revealed its plan for Downtown Dubai, including the Burj Khalifa and the Dubai Mall. This was also a significant event that helped mark the opening of the DFM to foreign investors

- Etisalat (2002) is another well-received mention, attracting a high level of interest, would be major regional telecommunications provider as part of its strategy to diversify its investor base

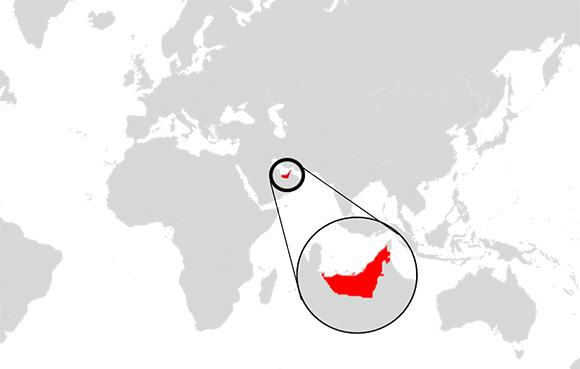

Strategic location, stability and infrastructure

Situated in the Middle East, sharing boarders with both Saudi Arabia and Oman, the UAE lies on the central cross-roads of trade routes from the West, Asia and Africa. Its appealing location and world-class infrastructure has been drawing in businesses to establish themselves and utilise the markets access point. In terms of stability, the UAE is a star developing country with a high-income1 (US 88k USD, GNI per capita) status. The investment proposition is further supported by the remarkable strength of the government’s fiscal position, net asset position, and a high GDP (per capita). This has been reflected in the high-quality, AA- investment grade ratings tied with stable outlooks of its sovereign bonds across the credit rating agencies2.

Another point that emphasises the UAE’s stability, is the official currency, Emirati Dirhams (AED), is pegged to the US dollar. This is advantageous for a net oil exporter, helping dampen volatility, as oil is denominated in USD.

Some highlights include:

It is strategically located along the Strait of Hormuz. This is a critical global crude oil transit point where c. 40 per cent of the world’ crude passes through. The UAE is home to several state-of-the-art ports interconnected to global shipping routes. These ports are improving their capabilities year on year, servicing larger volumes of customers whether its containerised cargo, bulk shipments, or energy. One example is the Khalifa Port in Abu Dhabi. This has the Middle East and North Africa (MENA) regions first semi-automated and most technologically advanced container port serving 25 shipping lanes with capacity alone for 7.8m TEUs per annum3, this is expected to rise to 9.1m TEUs per annum in 2024. Furthermore, it was the first to be linked to the UAE’s new Etihad Rail network, another remarkable infrastructure project that strengthens the UAE’s position as a leading global logistics and business hub4.

Another feature the UAE is capitalising on is its location, with more than two-thirds of the world's population within an eight-hour flight5. Dubai International Airport has become a premier global aviation hub retaining its title as the busiest airport by international passenger traffic in the world for a tenth year in a row6. The airport is undergoing a significant expansion project transforming the hub into a smart airport. There are two well-known world leading airlines based in the UAE, Emirates and Etihad, soaking up much of the international demand and aiding tourism.

1. Note: The World Bank classifies high income in 2024 as a country with a GNI >US 13,846 USD. Source: WB, World Atlas Method, 2024

2. Note: An average sovereign credit rating calculated across the three major credit rating agencies. Source: S and P Global Ratings Moody’s, and Fitch Group with

3. Note: TEU = Twenty-foot Equivalent Unit. Source: Abu Dhabi Ports

4. Source: The United Arab Emirates’ Government portal

5. Source: The Government of Abu Dhabi Crest portal

6. Source: Airports Council International (ACI)

Population demographics

The population in the UAE has witnessed significant growth over the past few decades, from a total population of c 4.3m back in 2005, that has since risen to 9.4m in 20221. The working age population in the UAE stands out as it continues to grow with the UN forecasting growing numbers through to 2100 (please see the chart below). Two key notes to highlight in the UAE are the relatively young median age of 33.5 years1, and that only 1m2 of the 9.4m total population are citizens. Expatriates form a substantial part of the community, outnumbering it’s citizens by more than 8x and most of the population reside in Abu Dhabi and Dubai. The population demographic also intertwines with its economic trajectory and includes a dynamic mix of skilled and non-skilled workers. Leading fields providing high employments figures include the finance, construction, hospitality and technology sectors.

As an expatriate majority population, we see a structurally resilient unemployment rate (see the chart below). On the one hand, you have expatriates returning home when employment closes, curbing the rate, but nonetheless, the low historic rate and pull back from the COVID pandemic is a testament to the UAE as an attractive destination for job seekers and entrepreneurs.

1. Source: World Bank Population Division (2022), 31 March 2024

2. Source: U.AE

We see population growth coming from the economic and social reforms discussed in the liberalisation section, attracting FDI and labour. The continued development of the UAE as a highly desirable business location will lead to further diversification, more and more opportunity in the region. Underpinning population growth and retaining foreign talents are new visa programs (such as the Golden Visa Program), with pathways to citizenship and family planning financial incentives for citizens.

There are also frameworks outlined by the government such as the Dubai 2040 Urban Master Plan to accommodate population growth, with supporting services and community development.

Economic diversification

The UAE’s Tourism industry is one of the major components of its economy diversifying strategy to lessen its dependency on oil. For context, in 2022, travel and tourism brought in nearly AED 167bn, equating to c. 9 per cent of the total GDP. The governments ambitions are in its forecasts where they are looking to drive this contribution to 12.4 per cent in 2027, and then continue rising to a target state of 15 per cent in 2031 (see chart below), highlighting its importance to the economy.

This sector typically supports a large number of jobs being created from areas such as hospitality, to retail and transport. Ultimately, a booming tourism industry can help attract FDI.

Summary

The UAE is a dynamic, fast developing country that is continuing to provide a wealth of opportunity as its economy grows and diversifies. It has been exploiting its geocentric location with the construction of world class infrastructure. Renowned for political stability and a business-friendly environment, the liberalising economic and social reforms we are witnessing make for an all the more attractive investment case.

The Investment Case

The case for Frontier Markets funds

- Attractive valuations. Frontier Markets are trading at a large discount to their emerging market peers, and offer higher earnings growth and higher dividend yields

- Diversification benefits. Frontier Markets have a low correlation with other asset classes, and lower volatility than Emerging Markets

- Superior earnings growth. Driven by structural change, Frontier Markets earnings growth is expected to remain strong in 2024