Fixed Income Insights

In a nutshell

How will increased defence spending and Germany’s fiscal boost impact the European economy?

- Draghi'sOvercoming structural challenges in Europe, such as low productivity growth and insufficient R&D investment, remains critical. Mario blueprint emphasizes the need for higher public and private investment, simplified regulations, decarbonization, and increased market integration to address these issues and ensure long-term competitiveness. More recently, European economies are also facing significant external risks, notably from U.S. trade tariffs

- However, Germany's EUR 500bn infrastructure fund is expected to act as a stimulus to counter these adverse effects. This plan, marking a major departure from Germany's traditionally austere fiscal stance, aims to boost domestic demand and sentiment. It is projected to raise Germany's GDP by nearly 1 per cent and the Eurozone's GDP by 0.4 per cent by 2026

- Additionally, increased defence spending across Europe is being prioritized as countries respond to reduced U.S. military commitments. While many NATO nations have reached the 2 per cent of GDP defence spending target, discussions to raise this further to 3 per cent or even 5 per cent could potentially add to economic growth. However, the positive spillovers of military R&D into private-sector productivity may require more time to materialize

How will increased defence spending and Germany’s fiscal boost impact European credit markets?

- European corporate credit markets are entering this period of geopolitical uncertainty with robust fundamentals. Companies have maintained steady leverage levels, resilient profitability, and strong cash buffers. Default rates are expected to remain between 2 per cent and 3 per cent, reflecting a healthy credit environment despite external pressures

- The Euro credit market has experienced significant growth over the past decade, with the Investment Grade Corporate Index's face value doubling and a 50 per cent increase in issuers. Enhanced sectoral diversity within the market has improved resilience, reducing systemic risks during economic downturns

- Certain sectors, including banking, telecommunications, and utilities, are well-positioned for growth, supported by favorable policies and stable regulatory frameworks. In contrast, more vulnerable industries like automotive and construction face external risks, including U.S. tariffs and cyclical market trends

- Overall, spread valuations in European credit markets remain tight, calling for cautious positioning amid macroeconomic uncertainty. However, elevated yields and sector diversification, particularly in hybrid securities and sustainable bonds, offer opportunities for investors seeking higher returns without sacrificing credit quality

Source: NATO, European Council, Centre for European Economic Reform, IMF, Bofa ICE indices, Moody’s rating, Macrobond, Bloomberg, HSBC Asset Management, May 2025.

How will increased defence spending and Germany’s fiscal boost impact the European economy?

Germany, a typically fiscally prudent country, announced a large fiscal stimulus aimed at reviving its stagnant economy. This is momentous, given the growing need for defence spending in Europe. This will likely lead to higher sovereign bond yields over the medium term.

Europe has faced and continues to face many challenges. These include poor productivity, trade tensions, and a shortfall of defence spending in the face of the US defence guarantee withdrawal. This is on top of other deeper structural issues such as an ageing population.

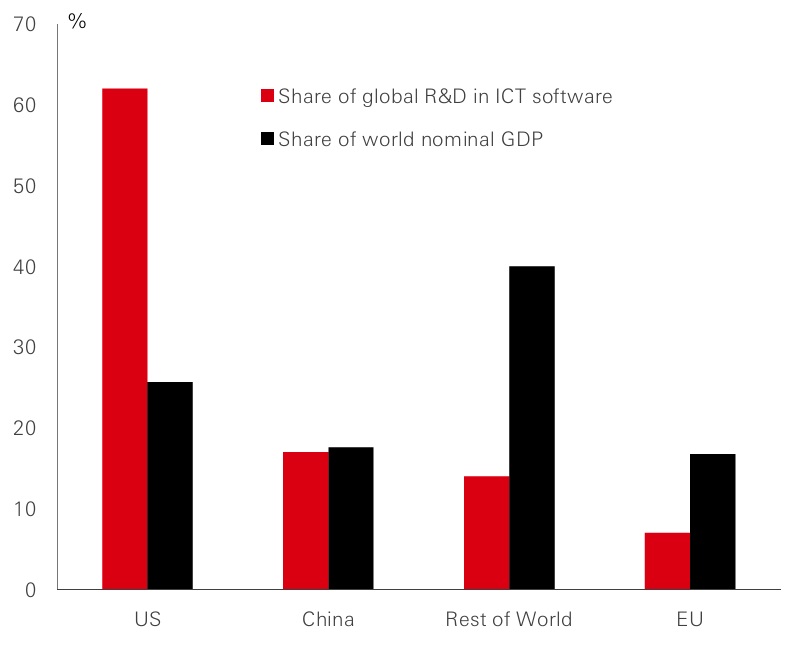

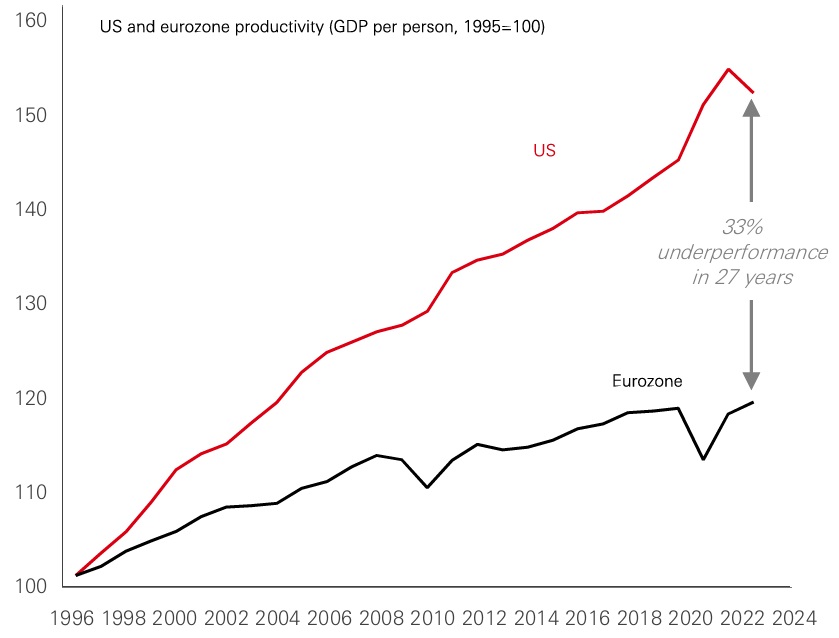

Since the global financial crisis, Europe’s annual growth rate has averaged only 1 per cent, largely due to a substantial productivity gap relative to the United States. This has resulted in an underperformance of about 1.2 per cent growth per year since the mid-1990s. A key factor is the lack of investment in research and development (R&D). The eurozone's share of global R&D in information and communication technology (ICT) software is under 10 per cent, well below the 60 per cent-plus for the US and notably lower than the EU’s share in global nominal GDP. Moreover, the EU’s budget is only around 1 per cent of GDP, much of which is spent in areas other than investment. Accessing funding for investment is also often a complex process. Public spending on investment is largely conducted at the national level. This means spending is not well coordinated and not necessarily allocated towards the EU’s strategic priorities.

Figure 1: Meagre R&D in ICT

Click the image to enlarge

Figure 2: Large productivity gap to the US

Click the image to enlarge

Source: Centre for European Economic Reform, Macrobond, HSBC Asset Management, March 2025.

In addition to poor productivity performance, the EU now faces the added headwind of US tariffs. Initially, these were set at 20 per cent but have since been delayed for 90 days. At the time of writing, the EU is subject to a 10 per cent baseline tariff (some sectors, such as autos are subject to a 25 per cent tariff). The EU has responded in a limited way and negotiations are currently underway. If tariffs are maintained at their present level, they will be a meaningful drag on growth, given the negative impacts on trade flows, uncertainty and confidence.

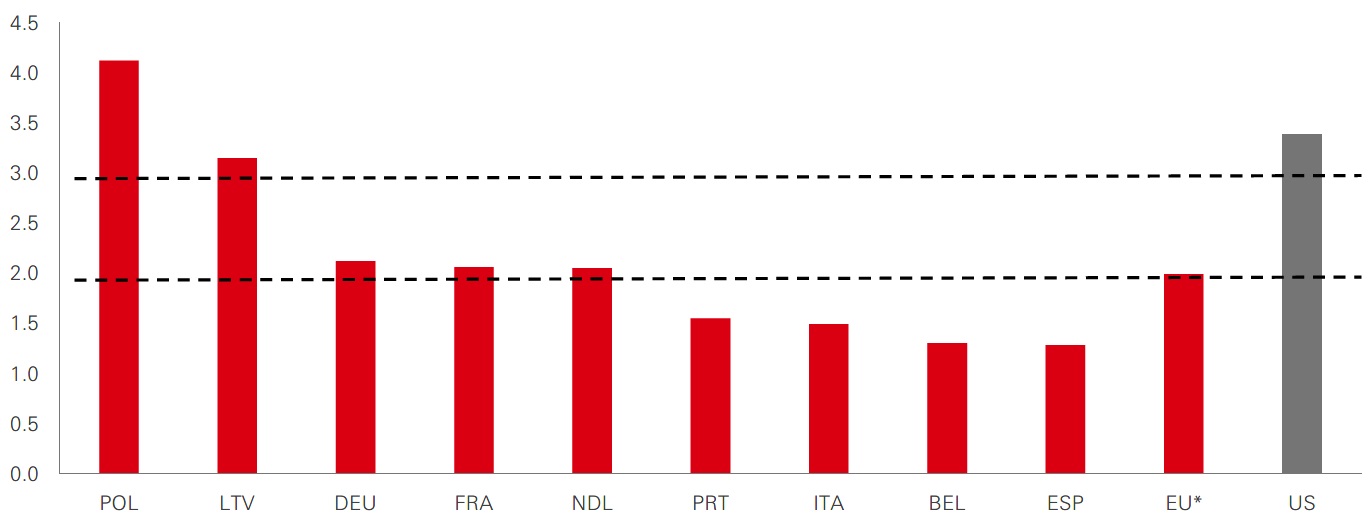

However, Europe’s domestic policy environment is shifting and becoming more growth supportive. Increased defence spending has become a top priority given the US has signalled a reduction in military support with its commitment to NATO now a source of debate. European leaders are reassessing their defence capabilities, with the Trump administration calling for European nations to increase their contribution. Heightened security concerns from the Russia-Ukraine conflict have already led to increased spending across the continent. Since 2022, many NATO member states have met the alliance's 2 per cent GDP spending target, while countries like Portugal, Italy and Spain plan to reach it by 2028/29. However, there has been some discussion within NATO about raising the target to 3 per cent, which would require an additional EUR 180bn of funding for the eurozone NATO members. Moreover, the US has even suggested increasing the target to 5 per cent.

Figure 3: Defence Spending (per cent of GDP, 2024e)

Click the image to enlarge

Source: NATO, European Council, HSBC Asset Management, March 2025. *EU GDP is actual and not expected

Increased defence spending would provide a direct boost to growth. It could also produce positive spillovers if military R&D yields products that are multi-purpose in nature and raise private-sector productivity. This, however, may take an extended period to materialise and is only a relatively small step in addressing Europe’s structural problems.

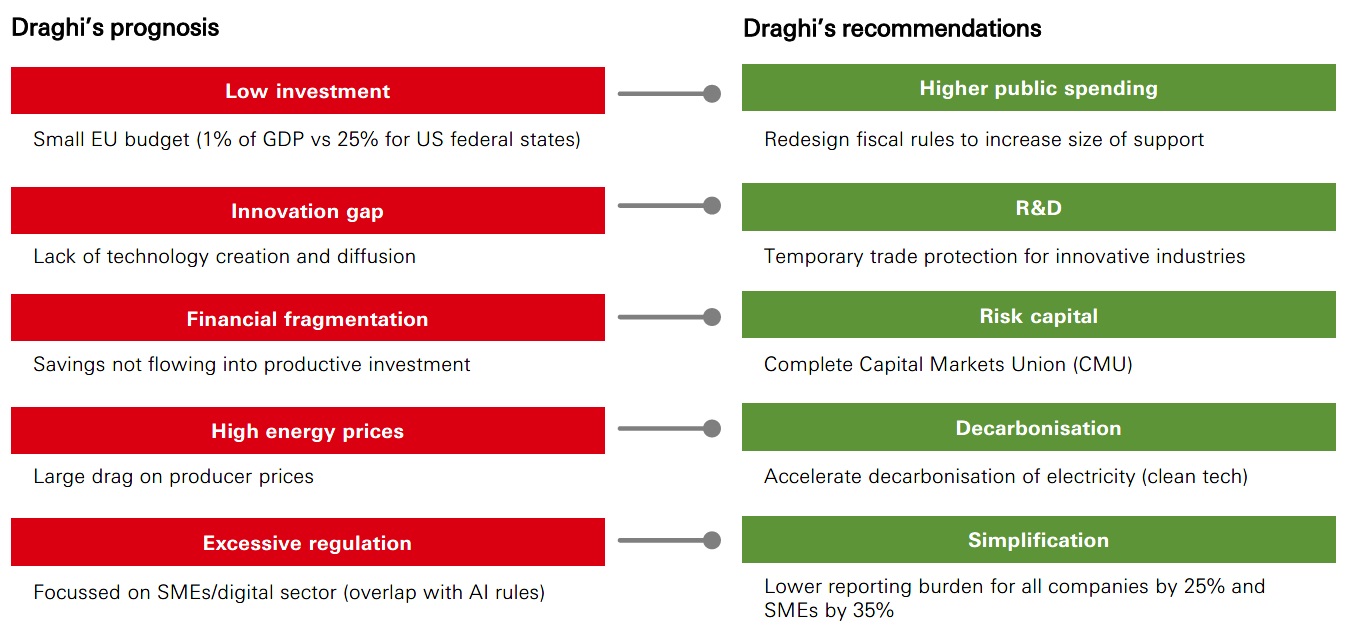

Mario Draghi has outlined a seminal blueprint for the economic revival of the European Union. Germany’s fiscal package arguably could be the first step in that direction.

In September 2024, Mario Draghi, ex-ECB president and ex-Italian Prime Minister, released a pivotal paper outlining the key structural issues that Europe faces, and target areas that could revive European competitiveness. His stated motivation is driven by the likelihood that Europe’s ageing population implies that the economy may be no larger in 2050 than it is today, unless productivity growth rises materially. He calls for more integrated markets, benefitting startups via the scaling of their customers and financial backers. Mr Draghi also wants to unify decision-making on public investments, slash business regulation, and link up electricity grids. A key focus was that Europe needs public and private investment to rise from today’s 22 per cent of GDP to 27 per cent. This step appeared inconceivable given the eurozone’s largest economy, Germany’s, reputation for fiscal austerity. However, times are changing.

Figure 4: “The future of European competitiveness – A competitiveness strategy for Europe” Report by Mario Draghi

Click the image to enlarge

Source: “The future of European competitiveness – A competitiveness strategy for Europe” Report by Mario Draghi, HSBC Asset Management, March 2025.

Germany has embarked on a substantial fiscal stimulus aimed at revitalising its stagnant economy. Past fiscal conservatism provides significant headroom compared to other nations, allowing Germany to engage in spending without alarming financial markets. All else being equal, the new infrastructure fund is expected to raise German GDP by almost 1 per cent and eurozone GDP by 0.4 per cent in 2026; however, many other factors are also at play.

Following the General Election in February, Germany has announced a significant policy shift with a EUR 500bn infrastructure fund, set to be allocated over 12 years, hoping to re-ignite new growth drivers in the country. The increased demand will likely create positive spillovers to the rest of the eurozone. This fund, representing about around 12 per cent of Germany’s 2024 GDP, will address critical issues in sectors like railways, schools, and digital infrastructure. The agreement among the CDU/CSU, SPD, and Green Party marks a pivotal moment in fiscal policy, as increased investment can expand the productive potential of the economy, rather than merely responding to immediate economic pressures. The inclusion of EUR 100bn into the climate and transformation fund reflects a commitment to green investments, and ensured the support of the Green Party, which was needed to help push the policy through parliament.

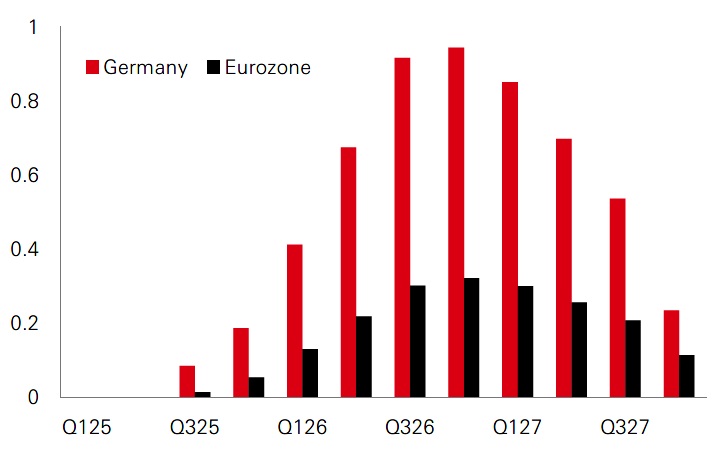

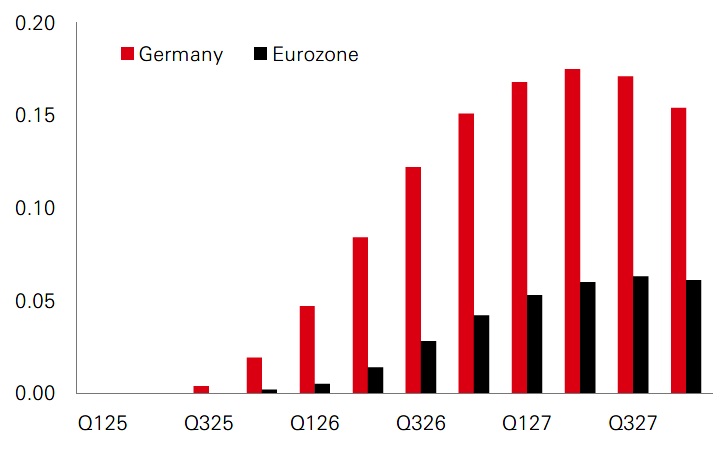

Using the Oxford Economics macro model, analysts project this infrastructure fund could contribute almost an additional 1 per cent to German growth and 0.4 per cent to the Eurozone in 2026. Public investment has the ability ‘crowd in’ the private sector via greater business confidence, encouraging a virtuous cycle of further rounds of spending. This is known as a fiscal multiplier. Other countries may also be encouraged to follow a similar path but may face greater fiscal limitations. While stronger growth implies somewhat higher inflation, the impact is likely to be limited – econometric models suggest German inflation could be around 0.2pp higher by 2027.

Figure 5: GDP yoy growth: difference from baseline (per cent)

Click the image to enlarge

Figure 6: CPI yoy inflation: difference from baseline (per cent)

Click the image to enlarge

Source: Oxford Economics, HSBC AM, March 2025.

The other elements of the package, beyond the infrastructure fund, could compound growth further. Germany’s constitutional debt brake previously mandated that individual states maintain structurally balanced budgets. The new proposal now includes a provision of a 0.35 per cent structural deficit for the states. The plan sets out to reform the federal part of the debt brake to avoid over-restriction of investment opportunities, although no details are currently published. Furthermore, defence spending over 1 per cent of GDP will be exempt in the calculation of the debt brake.

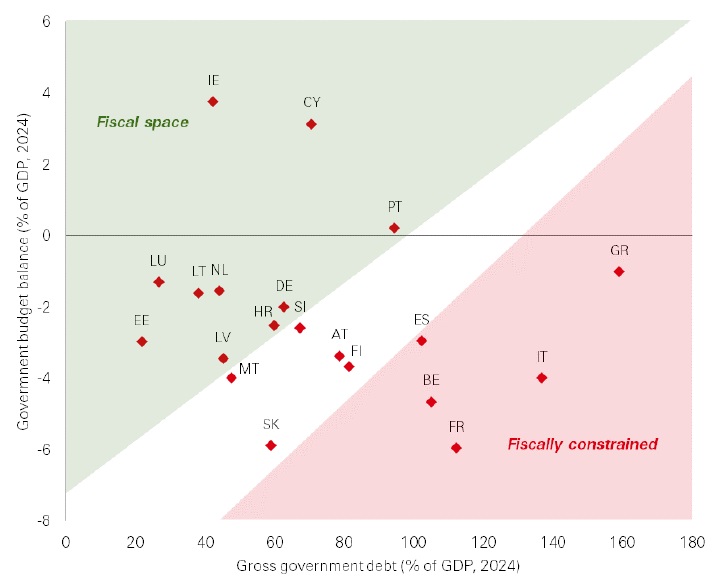

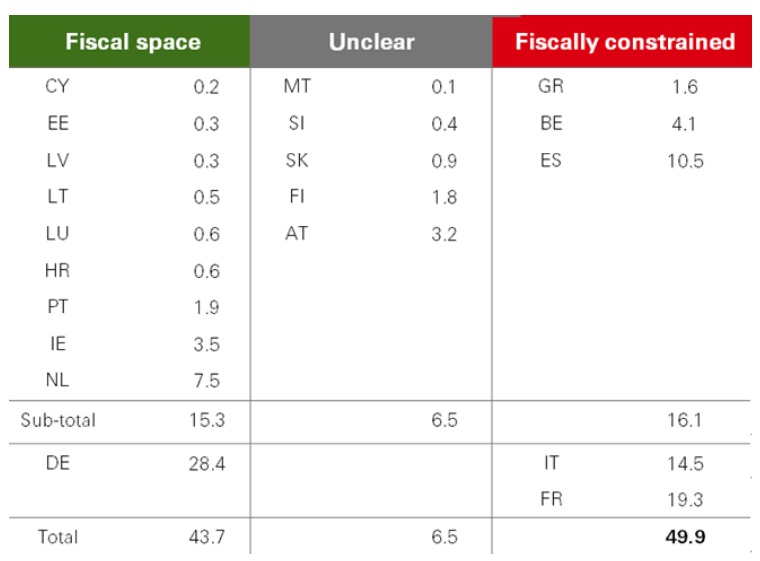

While Germany can press ahead with fiscal expansion, other eurozone economies, such as France and Italy, are more constrained. Countries with sufficient fiscal space only amounts to 15 per cent of overall eurozone GDP, so funding solutions may require EU-level action.

The fiscal space available to other eurozone countries is more limited. Approximately 50 per cent of eurozone countries fall into the fiscally constrained category, including Italy and France, with government debt-to-GDP ratios exceeding 100 per cent. These countries face larger challenges in increasing defence spending and stimulating growth relative to Germany.

Figure 7: Debt deficit and fiscal space

Click the image to enlarge

Figure 8: Share of Eurozone GDP (per cent)

Click the image to enlarge

Source: Macrobond, IMF, HSBC AM, March 2025.

German bund yields initially spiked higher in response to the fiscal stimulus proposals. However, they have since declined in line with concern that the negative growth impact of US trade tariffs will offset the boost from looser German fiscal policy. Nonetheless, over the medium term, bunds may behave more in line with their pre-pandemic trend.

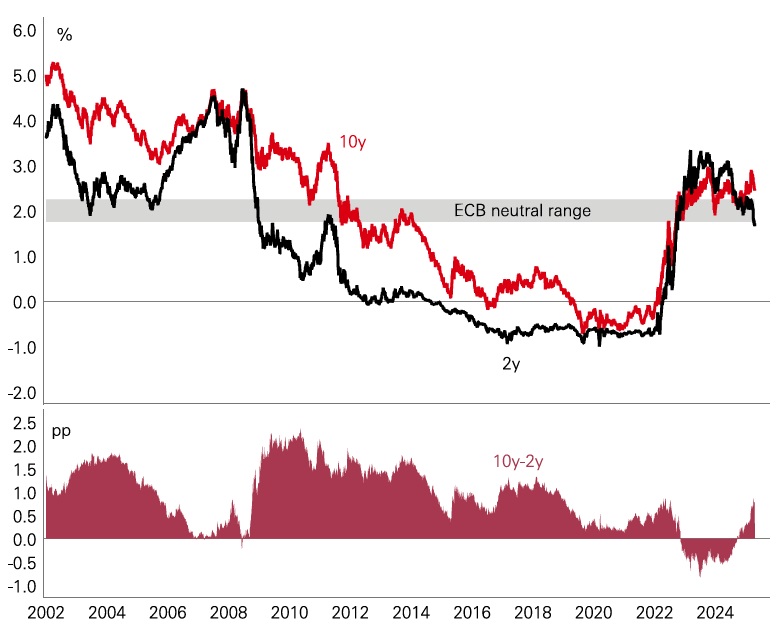

The recent fiscal package announced by Germany has raised questions about the outlook for European bond yields. In particular, the possibility of 10-year bund yields moving above 3 per cent on a sustained basis. The European Central Bank (ECB) has indicated that the neutral range for policy rates is around 1.75 per cent to 2.25 per cent, with the two-year German bund currently sitting just below this range. Historically, the German yield curve has exhibited a steepness of 100 basis points or more over sustained periods. With the German government increasing its bond issuance to finance the stimulus, market expectations for higher growth and inflation are likely to push up longer dated yields over the medium term, making 3 per cent-plus 10-year bund yields possible once headwinds from current trade tensions ease.

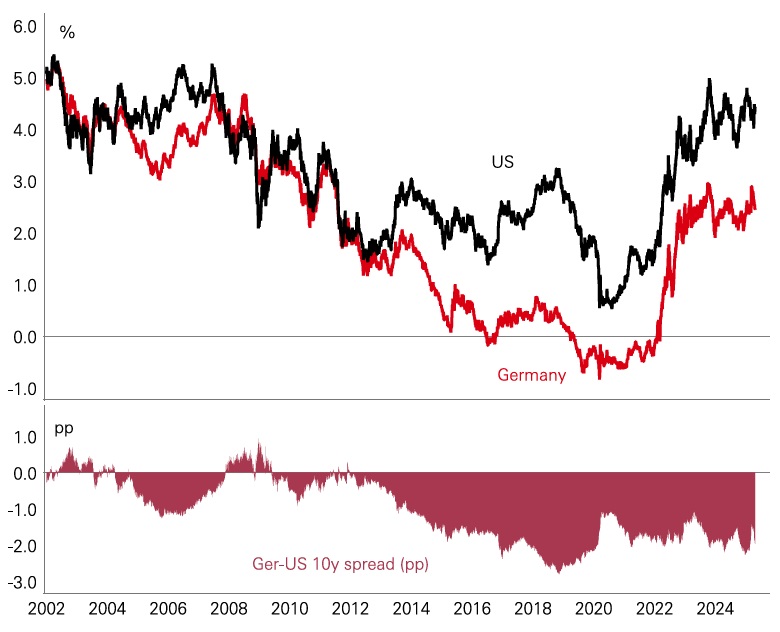

Accordingly, the post-Global Financial Crisis persistently wide 10-year spread between US and German bond could narrow. Alternatively, increased concern over US fiscal sustainability could drag global yields higher. However, much is contingent on factors such as the effective implementation of the German fiscal package and the broader economic response, including potential crowding-in effects on private sector investment. The implications for the eurozone's fiscal sustainability and the ability of other member states to manage rising borrowing costs will be critical to monitor as these developments unfold.

Figure 9: German curve can still steepen

Click the image to enlarge

Figure 10: Spread to US can still narrow

Click the image to enlarge

Source: Macrobond, HSBC AM, April 2025.

How will increased defence spending and Germany’s fiscal boost impact European credit markets?

Germany’s implementation of a significant fiscal stimulus could act as a catalyst for a change in sentiment in the Euro credit markets, particularly when combined with the anticipated need for increased defence spending across the region.

Prospects for the Eurozone economy are improving, with the likelihood of further interest rate cuts and the impending fiscal boost. Euro credit is likely to benefit from these developments, while it should be largely resilient to trade tariffs.

Economic visibility for the Eurozone has been enhanced by latest developments, especially the German fiscal package, where the direction of travel and political conviction are clear, even if risks to execution remain. Greater certainty will likely drive investment as there is need for companies to build up capacity, and with around EUR 300bn of EU savings currently invested outside the region each year, this could be reallocated to home markets and particularly early-stage technologies.

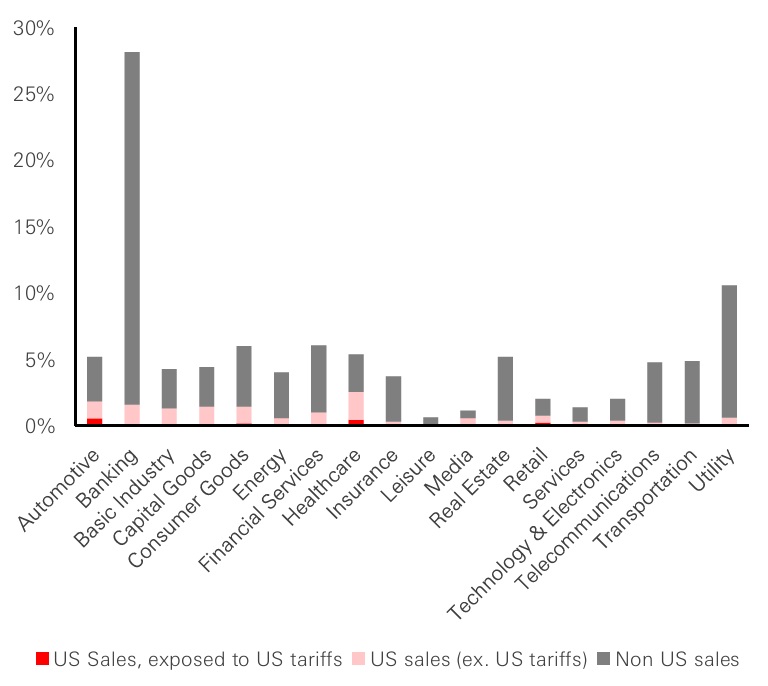

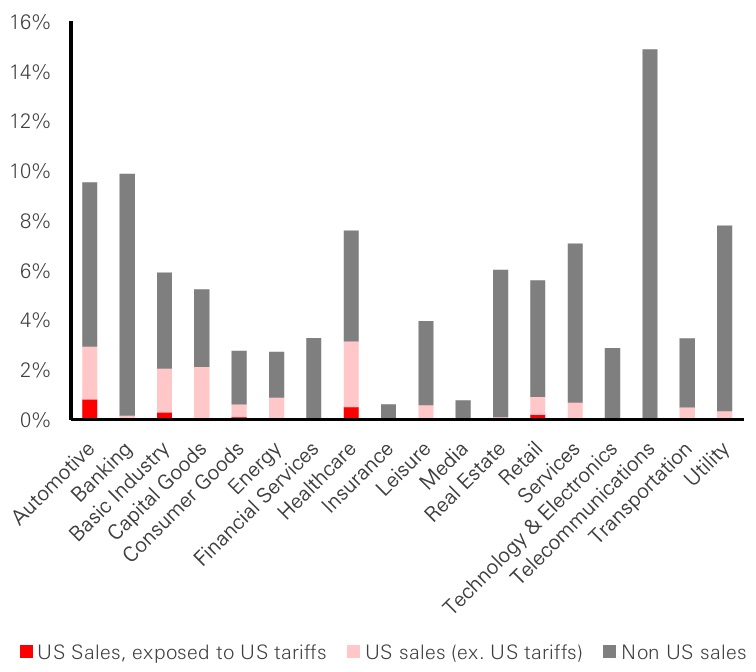

Even if tariffs are still an unknown quantity in terms of their scope, size and impact on the Eurozone’s economies, it is important to note that the Euro credit market has limited direct exposure. Notably,19 per cent of the Euro Investment Grade (IG) market and 9 per cent of High Yield (HY) is made up of US registered companies, while direct sales exposure to US tariffs remains limited in even the most affected sectors.

Figure 1: EUR IG Corp - Breakdown by sector, sales exposures to US tariffs

Click the image to enlarge

Figure 2: EUR HY - Breakdown by sector, sales exposures to US tariffs

Click the image to enlarge

Source: Bofa ICE indices, Bloomberg, HSBC AM, March 2025

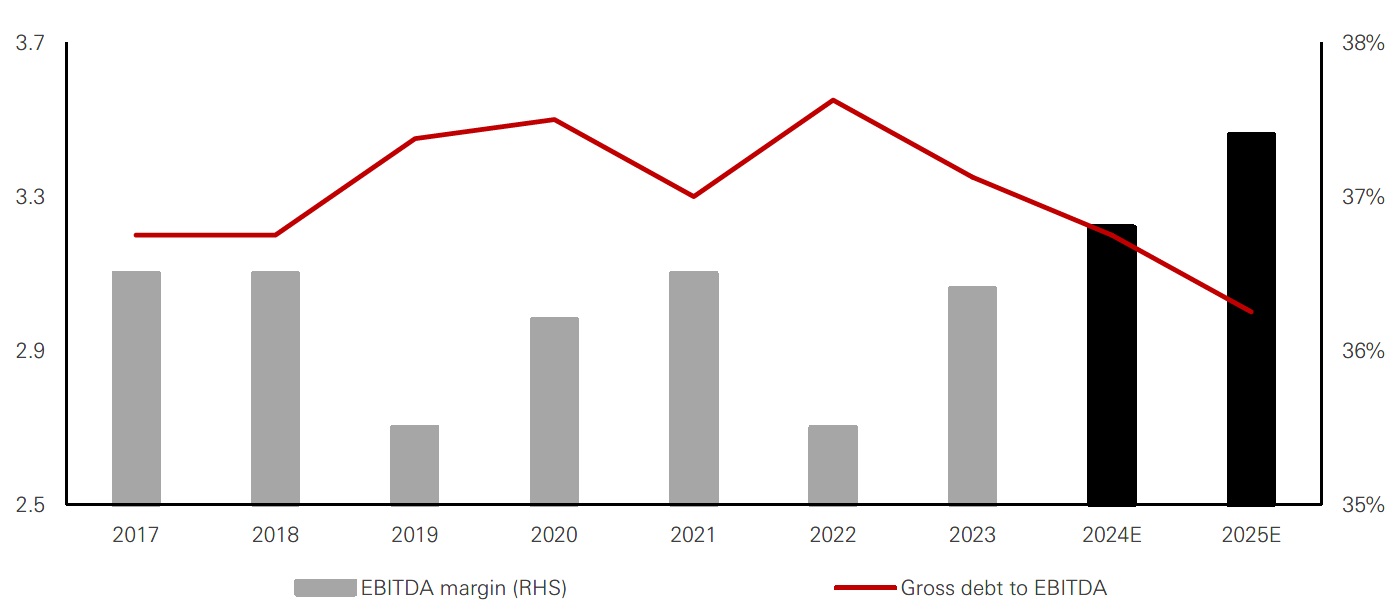

European corporate credits are entering this period of geopolitical tensions and economic uncertainty with healthy fundamentals, although there are risks to the downside. Gross leverage is steady and profitability is resilient. Despite a slight decline in coverage ratios, companies maintain strong cash buffers and projected default rates indicate a stable credit environment, supported by sector diversity.

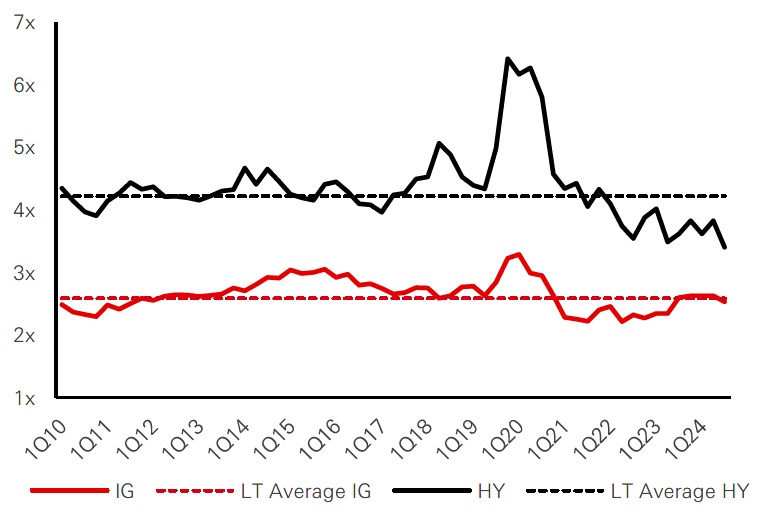

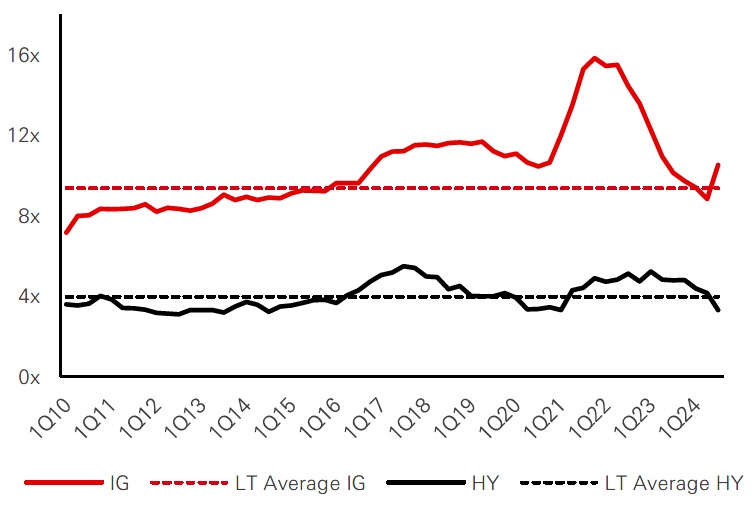

European corporate credit fundamentals are not exhibiting any significantly concerning vulnerabilities, with gross leverage close to long-term historical averages, suggesting that companies are managing their debt levels effectively despite the pressures of a subdued demand environment. EBITDA margins have proven surprisingly resilient given the backdrop of economic uncertainty, demonstrating companies’ operational efficiency and cost management discipline.

Coverage ratios have slightly declined as low coupon bonds are refinanced, but are close to long term averages, while cash-to-debt ratios remain relatively high compared to history, especially in High Yield, with companies maintaining substantial cash buffers to cushion any potential downturn.

Figure 3: Gross leverage – Stabilizing around long-term historical averages

Click the image to enlarge

Figure 4: Cover ratio – Declining as low coupon bonds are refinanced but still elevated in absolute term

Click the image to enlarge

Source: Bloomberg, HSBC AM, March 2025

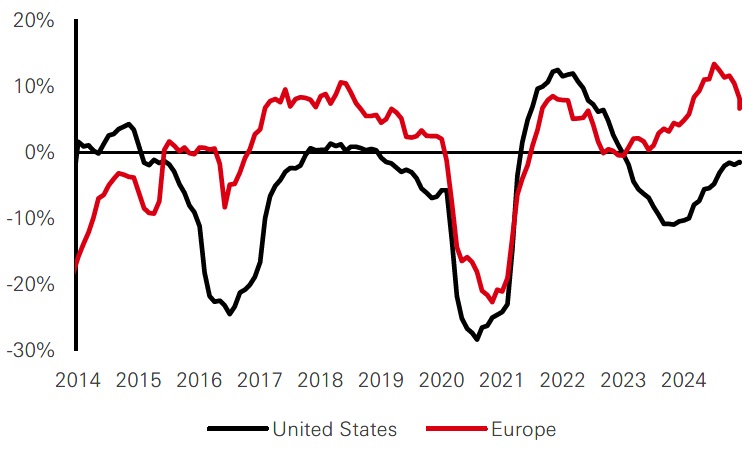

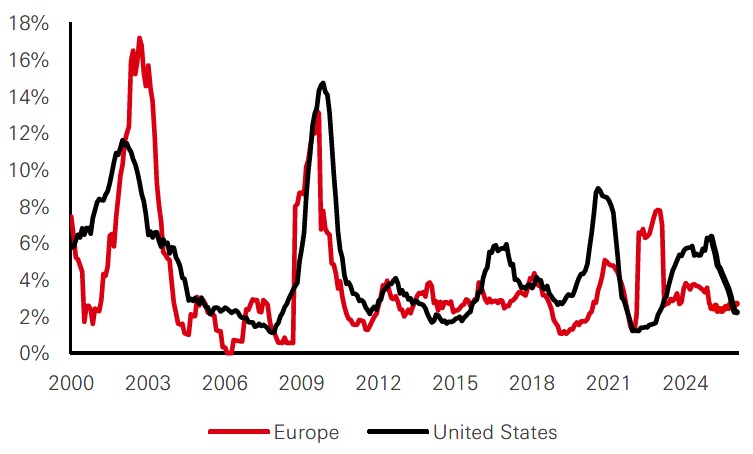

The default rate for European corporates is expected to hover between 2 per cent and 3 per cent over the next couple of years, indicating a stable credit environment, while ratings drift is likely to normalise following a period when banks were re-rated positively, which will reduce the number of rising stars migrating from high yield to investment grade. Meanwhile, fallen angels moving in the opposite direction, will remain at a level consistent with a mild economic downturn.

Figure 5: Rating drift – Normalization on track after massive positive re-rating of Banks

Click the image to enlarge

Figure 6: Default rate – Benign default environment planned for the next 12 months

Click the image to enlarge

Source: Bloomberg, HSBC AM, March 2025

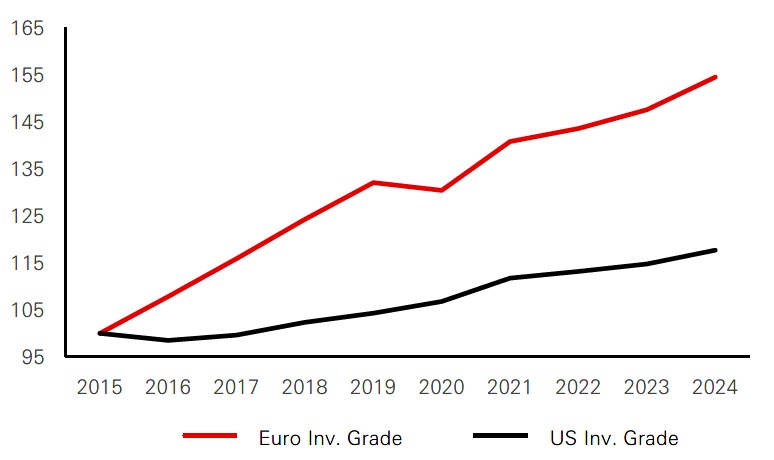

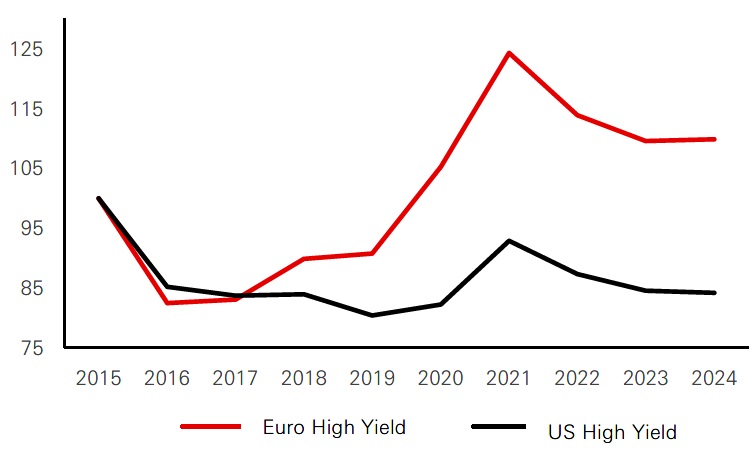

The European credit market has seen significant improvement in diversity over the past decade. The face value of the ICE BofA Euro Investment Grade Corporate Index has nearly doubled, while the number of issuers has increased by over 50 per cent, highlighting the market's dynamism for both issuers and investors. Positive trends are also evident in the HY segment, where the face value has risen by 25 per cent and the number of issuers has grown by 10 per cent. This contrasts with the US market, where the number of HY issuers has tended to decline. Today, the Euro credit market benefits from much better sector diversification, with no single sector dominating. This marks a significant shift from the early 2000s, when the TMT (technology, media, and telecommunications) sector was predominant in the high-yield space, or the Global Financial Crisis period, when the banking sector dominated the investment-grade space. This enhanced sectoral diversity provides the market with greater resilience, reducing its vulnerability to systemic risks arising from potential downturns in any single sector.

Figure 7: Investment Grade – Number of Issuers, 2015-2024

Click the image to enlarge

Figure 8: High Yield – Number of Issuers, 2015-2024

Click the image to enlarge

Source: Bloomberg; HSBC Asset Management, as of March 2025. Data has been indexed for comparability.

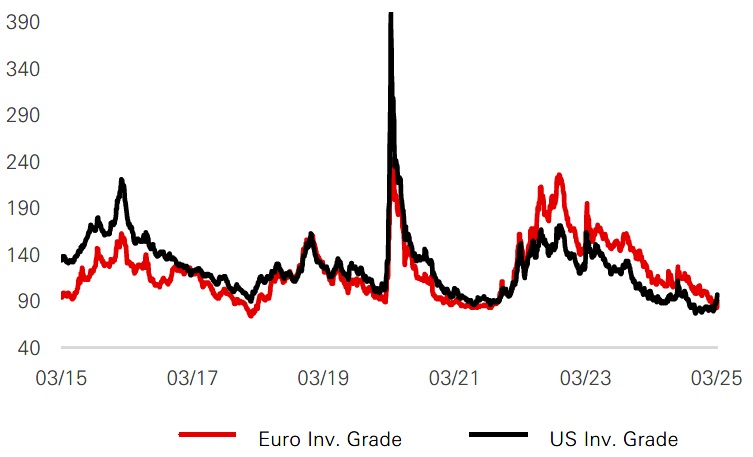

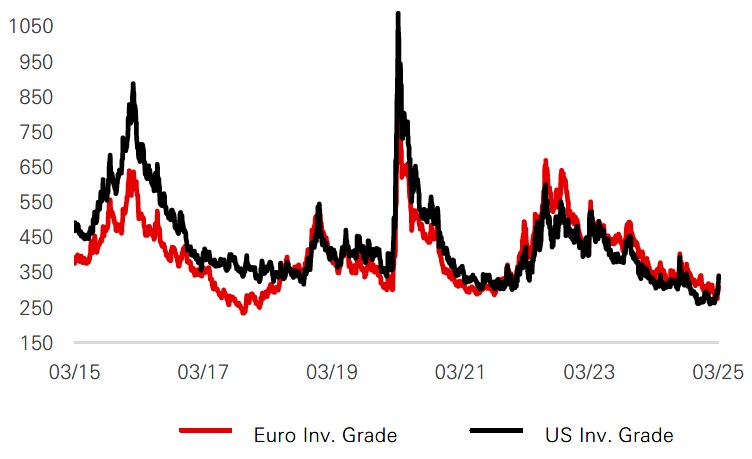

Spread valuations remain tight across global credit markets calling for a degree of caution in positioning against a backdrop of uncertain macro conditions, although spreads continue to be supported by elevated levels of overall yield. There is currently little difference in spreads between the US and Euro markets.

Figure 9: Investment Grade Government OAS Spreads

Click the image to enlarge

Figure 10: High Yield Government OAS Spreads

Click the image to enlarge

Source: Bloomberg; HSBC Asset Management, as of March 2025. Data has been indexed for comparability.

Another supportive characteristic for investors of the Euro credit is its much higher proportion of hybrid securities issued by high quality companies (c.10 per cent in IG and 25 per cent in HY) enabling to pick higher yield without giving up on credit quality. Finally, labelled bonds are denominated in EUR for c. 50 per cent of all labelled bonds issued on a global basis, leading to strategically higher allocation to EUR market for Sustainable or net zero transition strategies.

Beneficiaries of the extra fiscal spending include companies in the Defence, Steel, Construction, Electronics, Energy and Infrastructure sectors, while higher rates could be detrimental for vulnerable companies with low debt affordability outside these sectors.

The European defence industry is poised for significant growth, given EU plans to invest around EUR 800bn in defence over the next four years, made up of EUR 150bn in loans and EUR 650bn through waivers on Excessive Deficit Procedures. The urgency of this investment is complicated by the fact that the planned spending amounts are significantly higher than the current output of European defence companies. This suggests a need for bond issuance to build capacity, as the additional spending probably can’t be digested by the European defence industry alone. Major European players include BAE Systems, with USD 29.81bn in arms revenues, followed by Airbus and Leonardo.

Energy security remains a top priority of the Repower EU campaign. Europe successfully transitioned away from Russian oil following the implementation of direct and indirect sanctions in December 2023 and reduced its gas imports by 87 per cent, avoiding the worst-case scenario of deindustrialisation due to high energy prices. With LNG supply expected to outstrip demand by 2027, prices are forecast to decline, providing a positive boost for industrial sectors.

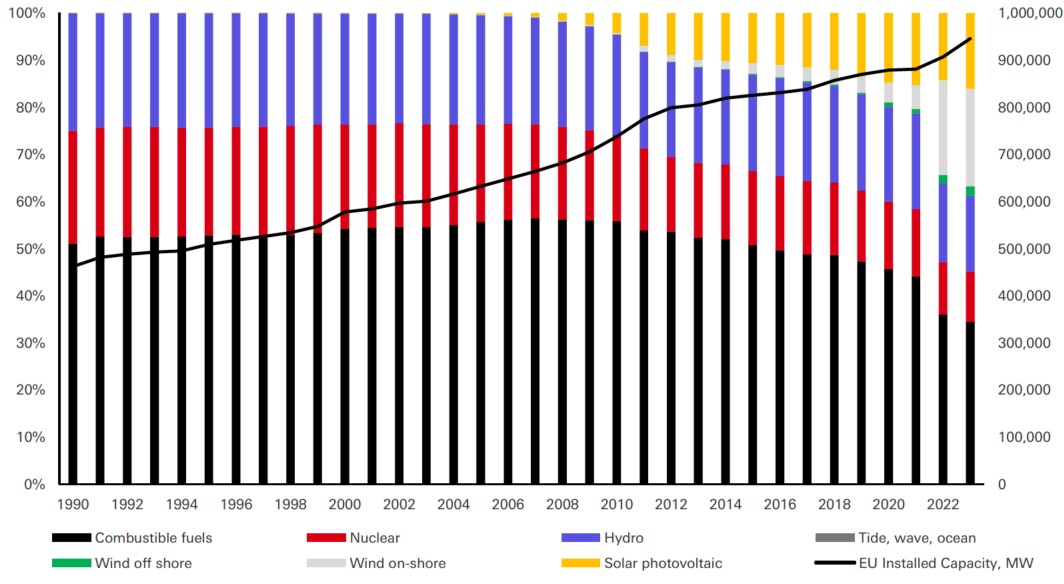

Even more importantly, the European Green Deal has driven a deep and rapid transformation of the EU power sector. Renewables increased their share from 34 per cent in 2019 to 47 per cent in 2024, while fossil fuels declined from 39 per cent to 29 per cent. Solar power remained the EU’s fastest-growing energy source in 2024, surpassing coal for the first time. Wind power continued to be the EU’s second-largest power source, ranking above gas but below nuclear.

Figure 11: EU Energy – Installed Capacity and Mix

Click the image to enlarge

Source: Moody’s rating; HSBC Asset Management, as of March 2025.

The impact of tariffs should be minimal on the banking sector, with the anticipated positive effects of economic stimulus packages likely to bolster loan demand. The sector is characterised by strong capitalisation levels, healthy profitability indicators, and adequate provisions for non-performing loans. Notably, the situation for French banks has improved, reflecting positive political developments which enhance operational stability.

In contrast, the automotive sector is particularly vulnerable due to U.S. tariffs and regulatory uncertainties in Europe. Concerns regarding pricing pressures and the potential for increased merger and acquisition risks, could further complicate the sector's outlook.

The telecommunications sector presents a more optimistic outlook. The sector is largely insulated from the direct impacts of tariffs, with most activities being locally based. The potential benefits from the EU defence package, particularly in cybersecurity, and the German infrastructure fund are expected to bolster the sector's fundamentals. In addition, the investments in fibre and 5G networks are now mostly done, which reinforces the operational profitability of telecom companies.

Figure 12: Gross leverage for EMEA telecom set to decline thanks to debt reduction for most levered operators and some EBITDA gains

Click the image to enlarge

Source: Bloomberg; HSBC Asset Management, as of March 2025. Data has been indexed for comparability.

Utilities in Europe also exhibit stable fundamentals, supported by a constructive regulatory environment and elevated electricity prices. Despite the challenges posed by a significant increase in supply driven by an investment super-cycle, selective opportunities in hybrid instruments from reputable issuers warrant consideration. Notably, the anticipated growth in regulated asset bases, particularly in the UK and Germany, is expected to drive earnings and support credit metrics.

Most companies in the capital goods sector express confidence in their ability to navigate current challenges with localised US manufacturing presence and decent pricing power, although there may be potential headwinds from capex delays in impacted end markets. Meanwhile, order trends from data centres, energy, utilities, mining, aerospace and defence are demonstrating strength.

The construction sector faces headwinds due to its indirect exposure to U.S. tariffs. Potential demand tailwinds from infrastructure-related projects and improvements in safeguard measures could support the sector. However, the cyclical nature of the construction sector makes it vulnerable in the event of an economic downturn.

The healthcare sector is characterised by a defensive outlook, with solid demand fundamentals. However, the potential for increased pricing pressures stemming from U.S. political developments introduces an element of uncertainty. The pharmaceutical industry, in particular, faces challenges related to tariffs on uncertain treatment of active pharmaceutical ingredients and the potential for regulatory changes that could impact pricing dynamics.

While certain sectors such as banking, telecommunications, and utilities present promising opportunities, others like automotive and construction warrant caution due to their heightened exposure to external risks. As investors navigate this landscape, a careful assessment of sector fundamentals, technical factors, and valuation metrics will be essential in making informed decisions. The outlook remains uncertain, with potential volatility expected to continue in the coming months.

Source: HSBC Asset Management, May 2025. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.