Effects of Interest Rate Movements on Securitised Credit

Many investors are concerned as to how their fixed income investments will react to changes in the interest rate environment. Securitised Credit (SC) is a low duration and predominantly floating rate asset class and therefore moves in line with interest rates – but there is a lagged impact to investors as these movements take time to flow through and take effect. Historically, as markets transition from rate hikes to rate cuts on economic slowdown fears, market volatility increases. This recent summer period has been no different.

However, there are some clear positives to the asset class:

1. SC benefits from a higher yield start point vs Investment Grade (IG) corporates and wide credit spreads versus longer term averages

2. SC also benefits from credit enhancement, a cushion against losses protecting investors from all but the harshest of recessionary environments

3. SC offers good diversification to fixed income investors and low correlations to traditional fixed income.

But what of the storms on the horizon?

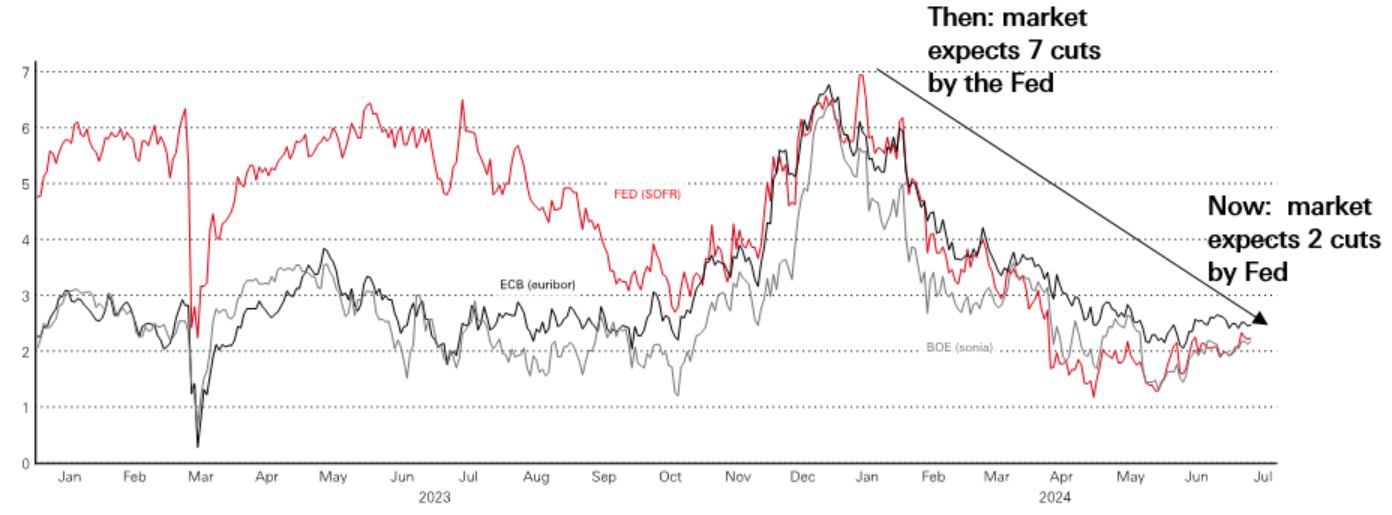

The market has had a recent history of wildly overestimating the most recent rate cut possibilities. When we look at the chart below, we can see that the market started 2024 pricing in 7 rate cuts by the Fed. This was then revised down to 2 rate cuts by the end of July.

Source: Bloomberg, HSBC Asset Management 31 July 2024

The weaker US jobs report, inflation cooling and the Bank of Japan telegraphing further rate hikes meant the market has gone very quickly from pricing a soft landing to a recessionary environment.

- This is not our base case

- Whilst defaults will increase, defaults are unlikely to be above longer-term averages

We believe rate cuts will occur, but that these will be gradual and measured in nature.

- There is currently no information in the market that demands large outsized rate cuts by central banks

- Rates are not expected to return back to zero, but back to a more neutral rate (circa 3.5% - 4.0% from their current levels)

We believe that a couple of rate cuts will be beneficial for the asset class, as this will make servicing the underlying debt more manageable (hence reduce loan defaults and delinquencies) whilst income generation on the floating rate bonds remains significant.

- This would also lead to potential spread tightening – allowing investors to benefit from a capital gain

It is also possible that this rate cutting cycle could be short in nature and that rates may well have to be increased again in a short period of time.

Conclusion

Investors should continue to consider Securitised Credit due to the high starting yield, wide credit spreads and credit enhancement protecting investors from all but the worst of recessions. The market has overpriced a recession and may well experience a different type of cycle than expected. The asset class delivered positive returns when rates were zero and will continue to deliver attractive returns going forwards in a more normal positive rate environment.

Source: HSBC Asset Management. The views expressed above were held at the time of preparation and are subject to change without notice.