Responsible Investment

2024, in a nutshell

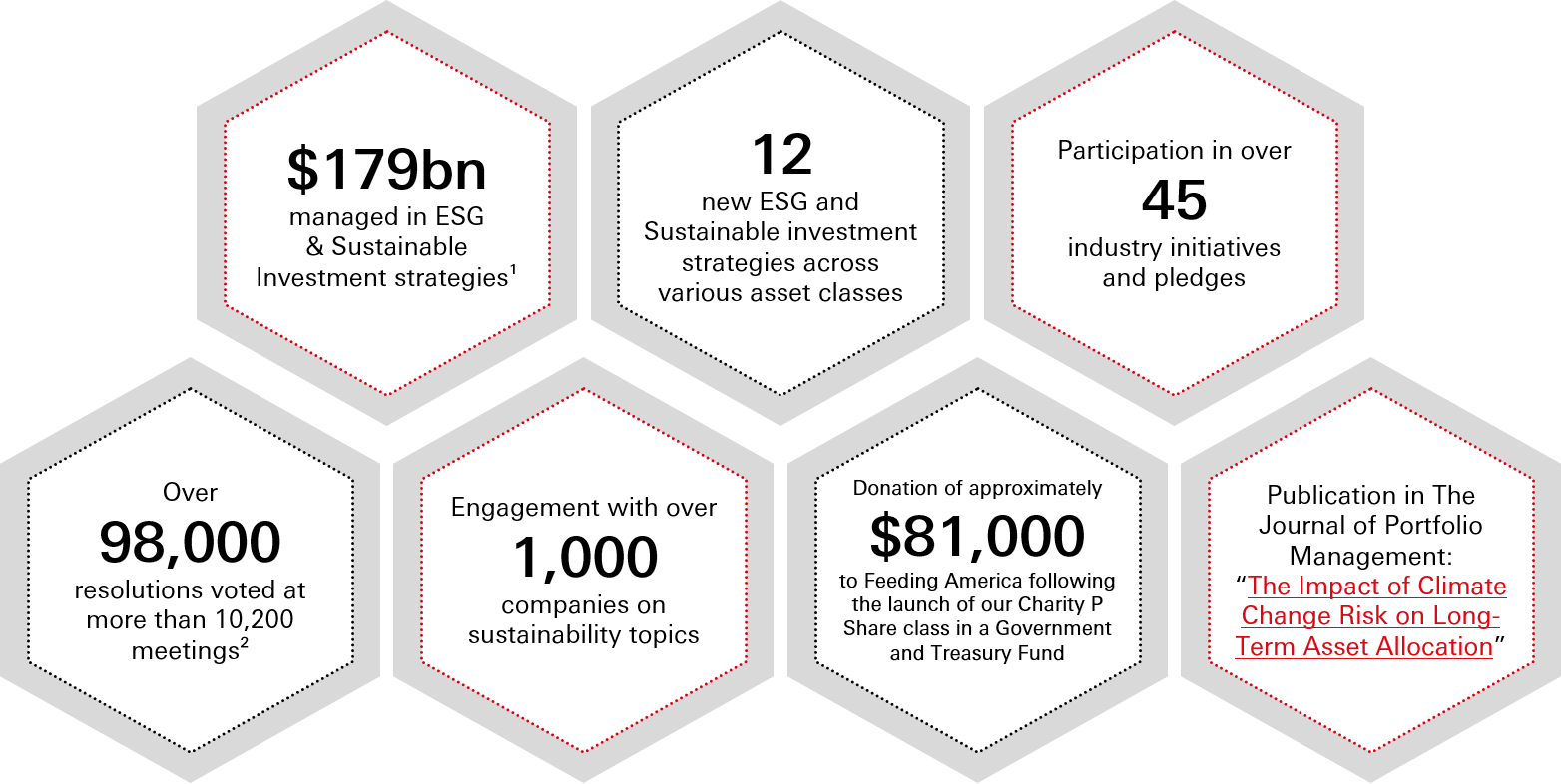

2024 was a year of progress for HSBC Asset Management in Responsible Investment. We are pleased to share an overview of our main key initiatives and achievements to support clients who have sustainable and decarbonation objectives.

1. Global assets under management: USD741bn. Source: HSBC Asset Management as on 31 Dec 2024. The HSBC ESG and Sustainable Investing Framework is an HSBC internal classification framework used to establish ESG and sustainable investing standards and promote consistency across asset classes and business lines where relevant, and should not be relied on to assess the sustainability characteristics of any given products. For the avoidance of doubt, these assets invested pursuant to the ESG and Sustainable Investing strategies do not necessarily qualify as "sustainable investments" as defined by SFDR or other relevant regulations.

2. Voting data covers our holdings across our offices where our global voting guidelines are applicable. Voting data from our offices in Argentina, Germany and Taiwan, as well as some from Japan, Mexico and Turkey is not included.

Today, we and many of our customers contribute to greenhouse gas emissions. We have a strategy to reduce our own emissions and to develop solutions to help our clients invest sustainably.

The information presented concerns the activity of HSBC Asset Management globally. We draw your attention on the fact that the numbers presented and the commitments listed are not necessarily a direct reflection of those of HSBC Asset Management in the various jurisdictions.

Our lead entity HSBC Global Asset Management Ltd is a signatory to the Net Zero Asset Managers initiative. It has an interim target of reducing Scope 1 and 2 financed emissions intensity by 58 per cent between 2019 and 2030 for its in-scope assets under management (AUM), consisting of listed equities and corporate fixed income managed within its major investment hubs. As of 31 December 2019, in scope assets amounted to USD193.9 billion, equating to 38 per cent of global AUM. Its targets remain subject to consultation with stakeholders including investors and fund boards on whose behalf it manages the assets. The 58 per cent target is based on assumptions for financial markets and other data, including the IEA Net Zero emissions by 2050 scenario and its underlying activity growth assumptions. Carbon emissions intensity is measured as tonnes of carbon dioxide equivalent per million USD invested (tCO2e/USDMillion invested), where emissions are scaled by enterprise values including cash. HSBC Asset Management is closely following the review that the NZAM Initiative has launched on the future of the initiative.